Category: fico score

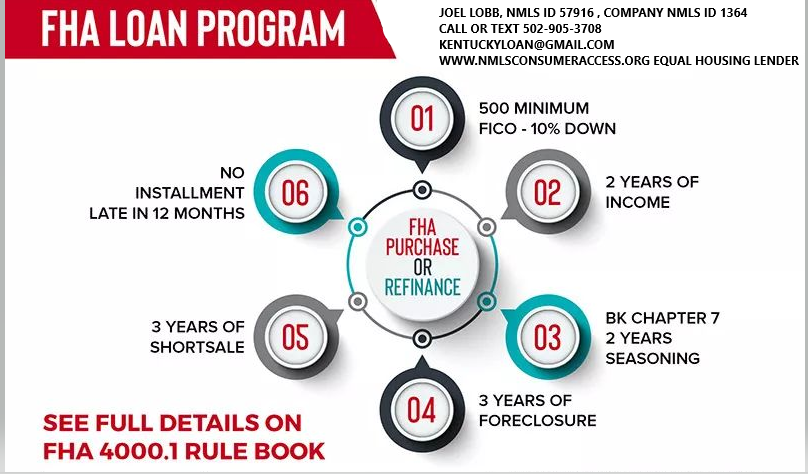

Qualifying for an FHA Loan in Kentucky

When it comes to buying a home in Kentucky, FHA loans are a popular choice for many first-time homebuyers due to their flexible qualifying criteria. If you’re considering an FHA loan in the Bluegrass State, understanding the key qualifying factors is crucial. Here’s a comprehensive guide to the criteria you need to know: Understanding these … Continue reading “Qualifying for an FHA Loan in Kentucky”

When it comes to buying a home in Kentucky, FHA loans are a popular choice for many first-time homebuyers due to their flexible qualifying criteria. If you’re considering an FHA loan in the Bluegrass State, understanding the key qualifying factors is crucial. Here’s a comprehensive guide to the criteria you need to know:

- Credit Score Requirements:

- FHA loans are known for accommodating borrowers with lower credit scores. While the minimum required credit score can vary, typically, a credit score of 580 or higher is needed to qualify for the minimum down payment of 3.5%. However, borrowers with credit scores between 500 and 579 may still be eligible with a higher down payment, usually around 10%.

- Down Payment:

- The minimum down payment for an FHA loan in Kentucky is 3.5% of the home’s purchase price. This is advantageous for buyers who may not have substantial savings for a larger down payment, making homeownership more accessible.

- Work History:

- Lenders typically look for a steady 2 year employment history when considering FHA loan applications. A consistent work history, preferably with the same employer or within the same field, helps demonstrate financial stability and the ability to repay the loan.

- Debt-to-Income Ratio (DTI):

- The debt-to-income ratio is a crucial factor in mortgage approval. For FHA loans, the maximum allowable DTI ratio is typically around 40% to 45% of your gross monthly income and can go higher up to 56% with good credit scores, large down payment or shorter term loan although lenders may consider higher ratios in certain cases if compensating factors are present.

- Bankruptcy and Foreclosure:

- FHA loans have lenient guidelines regarding bankruptcy and foreclosure. Generally, borrowers with a past bankruptcy may qualify for an FHA loan after two years if they have re-established good credit and demonstrated responsible financial behavior. For foreclosures, the waiting period is usually three years.

- Mortgage Term:

- FHA loans offer various mortgage term options, including 15-year and 30-year fixed-rate loans. The choice of term depends on your financial goals and ability to manage monthly payments.

- Occupancy: Primary residences not for rental properties

- Mortgage Insurance on the loan for life of loan. Larger down payments and shorter terms will reduce the upfront mi and monthly mi premiums

- can be used for refinances, not only for purchases.

- Max FHA loan in Kentucky is $498,257. This changes every year

- No income limits nor property restrictions on where home is located

- Can close within 30 days typically with good appraisal and title work

Understanding these qualifying criteria can help you navigate the FHA loan application process in Kentucky more effectively. Working with an experienced mortgage professional can also provide valuable guidance and assistance tailored to your specific financial situation and homeownership goals.

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS 57916 | Company NMLS #1364/MB73346135166/MBR1574

NMLS ID# 57916, (www.nmlsconsumeraccess.org).

What are the Kentucky FHA Credit Score Requirements for Mortgage Loan Approvals?

This content provides detailed information about Kentucky mortgage loan options, credit score requirements, and tips for improving credit scores. It covers FHA loan requirements, credit bureau scores, credit utilization, and factors affecting mortgage approval. The post emphasizes the importance of credit history and offers specific advice for maintaining a favorable credit profile to qualify for a mortgage in Kentucky.

Kentucky Mortgage Requirements for FHA, VA, USDA and Fannie Mae

FHA loan in Kentucky you will be confronted with minimum credit score requirements set forth by FHA and the lender. Even though FHA will insure the mortgage loan at a certain credit score, you will see that lenders will create “credit-overlays” to protect their risk and ask for a higher credit score.

So keep in mind when you are getting an FHA lenders will have higher credit score minimums in addition to the FHA Mortgage Insurance program.

For a Kentucky Homebuyer wanting to purchase a home or refinance their existing FHA loan, FHA requires a 3.5% down payment and the borrower must have a 580 FICO Credit Score. If the score is below 580, then you would need 10% down and still qualify on a manual underwrite.

You must have a FICO score of at least 500 to be eligible for a Kentucky FHA loan. If your FICO score is from 500 to 579, your down payment on the loan is 10 percent of the loan.

If your FICO score is 580 or higher, your down payment is only 3.5 percent. If your credit score is less than 580, it may be more cost-effective to take the necessary steps to improve your score before taking out the loan, rather than putting the money into a larger down payment.

How do they get the credit score: There are three main credit bureaus in the US. Equifax, Experian, and Transunion. The three scores vary but should be relatively close as long as the same creditors are reporting to the same bureaus.

You will get a variation in the scores due to all creditors or collection companies don’t report to all three bureaus. This is why they take the mid score. So if you have a 590 Experian, 680 Equifax, and 620 TransUnion, your qualifying credit score would be 620

Based on my experience with lenders that I deal with in Kentucky on FHA loans, most lenders require 620 middle credit score for consideration for loan approval.

How do they get the score: They take the mid score, so if you have a 590 Experian, 680 Equifax, and 620 TransUnion, your qualifying score would be 620.

Kentucky FHA Loans with less than 620 Score

If your score is below 620, a manual underwrite is where the AUS (Automated Underwriting System) refers your loan to a human being, and they look at the entire file to see if they can overturn and approve the mortgage loan because the Desktop Underwriting Automated Software could not approve you.

With scores below 620, they typically will want to verify your rent history, have no bankruptcies in the last two years, and no foreclosures in the last 3 years.

If you have had any lates since the bankruptcy this will probably result in a denial on a refer manual underwrite file.

Your max house payment will be set at 31% of your gross monthly income, and your new house payment plus the bills you are paying on the credit report cannot be more than 43%.

Typically, on scores below 620 for FHA loans, they will also look at reserves or money you have saved up after the loan is made to try and qualify you. For example, if you have a 401k or savings account that has at least 4 months reserves (take your mortgage payment x 4) and this would equal your reserves. They look at this as a rainy day fund and could help you keep up on your bills if you were unemployed or could not work.

Maximum FHA loan limits in Kentucky are set at $680 for 2022

If you are looking to take a FHA loan in 2022 to buy or refinance a home in Kentucky, please contact me below with your questions about the credit score requirements and how they affect your loan approval.

What credit score do you need to qualify for a Kentucky mortgage loan?

The first thing to keep in mind is that qualifying for a mortgage involves a lot more than just a credit score. While your FICO score is a very important ingredient, it is just one factor. Lenders also look at your income and level of debt, among other things.

As a rule of thumb, however, a credit score below 620 will make buying a home very difficult. A FICO score below 620 is considered sub-prime. In the past, there were mortgage companies that specialized in sub-prime mortgages. Because of the challenges in the credit market over the last year or so, however, sub-prime loans have become difficult if not impossible to obtain.

A FICO score between 600 and 640 is considered fair to good credit. But keep in mind, this range of credit scores does not guarantee you will qualify for a mortgage, and if you do qualify, it won’t get you the lowest interest rate possible. Still, to buy a home aim for a score of at least 620, recognizing that other factors weigh in the decision and that some banks may require a higher score.

What credit score do you need to get a low rate mortgage?

It uses to be that a score of about 720 would yield the lowest mortgage rates available. Today, the best rates kick in with a FICO score of 760. And interest rates go up significantly as your credit score drops. To give you an idea, the following table shows current rates by credit score and calculates a monthly principal and interest payment based on a $300,000 loan:

lenders will pull what they call a “tri-merge” credit report which will show three different fico scores from Transunion, Equifax, and Experian. The lenders will throw out the high and low scores and take the “middle score.” For example, if you had a 614, 610, and 629 score from the three main credit bureaus, your qualifying score would be 614.

So if you only have one score, you may not qualify. Lenders will have to pull their own credit report and scores so if you had it ran somewhere else or saw it on a website or credit card you may own, it will not matter to the lender, because they have to use their own credit report and scores.

Lastly, lenders will pull your credit report for free nowadays so this should not be a big deal as long as your scores are high enough.

offered by FHA, VA, USDA, Fannie Mae, and KHC all have their minimum fico score requirements and lenders will create overlays in addition to what the Government agencies will accept, so even if on paper FHA says they will go down to 580 or 500 in some cases on fico scores,

If you have low fico scores it may make sense to check around with different lenders to see what their minimum fico scores are for loans.

The lenders I currently deal with have the following fico cutoffs for credit scores:

As you can see, different government-backed loan programs have different minimum score requirements with most lenders for an FHA, VA, or Fannie Mae loan, and 620 is required for the no down payment programs offered by USDA and KHC in Kentucky for First Time Home Buyers wanting to go no money down.

By paying down your credit card balances (credit utilization) and having a good pay history (payment history) ,this is the best way to raise your score.

The credit bureaus don’t update immediately, so I would not add to the balance or open any new bills or have any other lender do an inquiry on your credit report while we wait for the scores to hopefully go up in the next 30 days. Try to keep everything status quo and make your payments on time and keep your balances low or lower than what is now reporting on the credit report.

How to improve your credit score!

Pay Every Single Bill on Time, or Early, Every Month

Please understand one thing; paying your bills on time each month is the single most important thing you can do to increase your credit scores.

Depending on the credit bureau, there are 4 or 5 main items that determine everyone’s credit score. Of those items, your history of paying bills makes up about 35% of the score. THIS IS HUGE!

Paying your bills on time shows lenders that you are responsible. It will also spare you from paying late fees whether it is a charge from a credit card or an added fee from your landlord.

Use a calendar, or a phone app, or some other organized system to make sure that you pay your bills on time every single month.

MAIN TIP: Do not pay ANY bill late!

Credit Cards: Lower Balances Are Always Better

( If you don’t have a credit card, I suggest getting a secured credit card through Capital one Secured Card Or Open Sky Credit card...click this link here

Another big factor in calculating a credit score is the amount of credit card debt. Credit bureaus look at two things when analyzing your credit cards.

First, they look at your available credit limit. Second, they look at the existing balance on each card. From these two figures an available ratio is developed. As the ratio goes higher, so too will your credit score increase.

Here is one simple example. Suppose a person has the following credit cards, corresponding balances, and credit limits

| Credit Card | Current Balance | Credit Limit |

| Chase Visa | $105 | $1,000 |

| MarterCard from local bank | $236 | $1,500 |

| BP MasterCard | $87 | $500 |

| Totals | $428 | $3,000 |

From these numbers, we get the following calculation

$428/$3,000 = 14%

In other words, the person is using 14% of their available credit and they have 86% available credit. The closer that ratio is to 100%, the better the credit score will be.

MAIN TIP: Keep all credit card balances as low as possible.In this particular example, if they had a problem with their car, or needed medical attention or some other emergency, the person would have the money necessary to handle the situation without incurring new debt. This is wise on the consumer’s part and lenders like to see this kind of money management.

Credit Cards Part 2: 1 or 2 is Better Than a Wallet Full

The previous example showed a person that utilized just three credit cards. This is much better than someone who has 5+ credit cards, all with available balances. Why? Lenders do not like to see someone that has the potential to get too far in debt in a short amount of time.

Some people have 5, 10 or more credit cards and they use many of them. This shows a lack of restraint and control. It is much better, and neater, to have only 2 or 3 cards with low rates that handle all of your transactions. A lower number of cards are easier to manage and it does not give a person the temptation to go on a huge shopping spree that could take years to payoff.

MAIN TIP: Try to limit yourself to no more than 2-3 credit cards.

Keep the Good Stuff Right Where it is

Too many people make the mistake of paying off old debts, such as old credit cards, and then closing the account. This is actually a bad idea.

A small part of the credit score is based on the length of time a person has had credit. If you have a couple of credit cards with a long track history of making payments on time and keeping the balance at a manageable level, it is a bad idea to close out the card.

Similarly, if you have been paying on a car or motorcycle for a long time, do not be in a hurry to pay off the balance. Continue to make the payments like clockwork each month.

An account that has a good record will help your scores. An account that has a good record and multiple years of use will have an even better impact on your score.

MAIN TIP: Keep old accounts open if you have a good payment history with them.

Stop Filling Out Credit Applications

Multiple credit inquiries in a short amount of time can really hurt your credit scores. Lenders view the various inquiries as someone that is desperate and possibly on the verge of making a bad financial choice.Too many people make the mistake of getting more credit after they are approved for a loan. For example, if someone is approved for a new credit card, they feel good about their finances and decide to apply for credit with a local furniture store. If they get approved for the new furniture, they may decide to upgrade their car. This requires yet another loan. They are surprised to learn that their credit score has dropped and the interest rate on the new car loan will be much higher. What happened?

If you currently have 2 or 3 credit cards along with either a car loan or a student loan, don’t apply for any more debt. Make sure the payments on your current debt are all up to date and focus on paying them all down.

In a few months of making timely payments your scores should noticeably go up.

MAIN TIP: Limit your new loans as much as possible

Which credit scores do mortgage lenders use to qualify people for a mortgage?

While it’s common knowledge that mortgage lenders use FICO scores, most people with a credit history have three FICO scores, one from each of the three national credit bureaus (Experian, Equifax, and TransUnion).

- Which FICO Score is Used for Mortgages

Most lenders determine a borrower’s creditworthiness based on FICO® scores, a Credit Score developed by Fair Isaac Corporation (FICO™). This score tells the lender what type of credit risk you are and what your interest rate should be to reflect that risk. FICO scores have different names at each of the three major United States credit reporting companies. And there are different versions of the FICO formula. Here are the specific versions of the FICO formula used by mortgage lenders:

- Equifax Beacon 5.0

- Experian/Fair Isaac Risk Model v2

- TransUnion FICO Risk Score 04

Lenders have identified a strong correlation between Mortgage performance and FICO Bureau scores (FICO score). FICO scores range from 300 to 850. The lower the FICO score, the greater the risk of default.

Which Score Gets Used?

Since most people have three FICO scores, one from each credit bureau, how do lenders choose which one to use?

For a FICO score to be considered “usable”, it must be based on adequate, concrete information. If there is too little information, or if the information is inaccurate, the FICO score may be deemed unusable for the mortgage underwriting process. Once the underwriter has determined if a score is usable or not, here’s how they decide which score(s) to use for an individual borrower:

- If all three scores are different, they use the middle score

- If two of the scores are the same, they use that score, regardless of whether the two repeated scores are higher or lower than the third score

Lenders have identified a strong correlation between Mortgage performance and FICO Bureau scores (FICO score). FICO scores range from 300 to 850. The lower the FICO score, the greater the risk of default.

If it helps to visualize this information:

| Identifying the Underwriting Score | ||||

|---|---|---|---|---|

| Example | Score 1 | Score 2 | Score 3 | Underwriting Score |

| Borrower 1 | 680 | 700 | 720 | 700 |

Joel Lobb

Mortgage Loan Officer

Individual NMLS ID #57916

American Mortgage Solutions, Inc.

Company NMLS ID #1364

click here for directions to our office

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

https://www.mylouisvillekentuckymortgage.com/

Joel Lobb

Senior Loan Officer

Senior Loan Officer

(NMLS#57916)

Company ID #1364 | MB73346

text or call my phone: (502) 905-3708

email me at kentuckyloan@gmail.com

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people. NMLS ID# 57916, (www.nmlsconsumeraccess.org). USDA Mortgage loans only offered in Kentucky.

All loans and lines are subject to credit approval, verification, and collateral evaluation

Kentucky Conventional Loan versus Kentucky FHA Loan comparison chart

This content discusses the credit score requirements, down payment options, and mortgage insurance for Kentucky Conventional and FHA Loans. It also outlines bankruptcy timelines for eligibility and provides contact information for Joel Lobb, a Senior Loan Officer. The disclaimer emphasizes that loan approvals are subject to various qualifications and conditions, and the content is not endorsed by any government agency.

Kentucky FHA Loans are good for borrowers who have the following:

• Credit scores less than 680.

• Less than 5% down payment and no reserves to use.

• Borrowers with past foreclosures between 3 and 7 years old.

• Borrowers with past short sales between 2 and 4 years old.

• Borrowers who need a gift for the down payment and/or closing costs, prepaid taxes and

insurance.

The FHA Mortgage Insurance premium is a premium that exists for the FHA Loan that is

paid up front and monthly by the homebuyer. This premium protects the lender should the

buyer default. They vary per state and per type of loan Kentucky home buyers qualify for. In Kentucky, upfront mortgage insurance premiums are 1.75%.

Below are the rates per type of loan:

• 15-Year Fixed with down payment more than 10%: .45%

• 15-Year Fixed with down payment less than 10%: .70%

• 30-Year Fixed with down payment more than 5%: .80%

• 30-Year Fixed with down payment less than 5%: .85%

Kentucky Conventional loans are usually reserved for the following:

• Credit scores greater than 680

• Greater than or equal to 5% down payment with reserves

• Borrowers with past foreclosures over 7 years old.

• Borrowers with past short sales between 5-7 years old.

• Borrowers who have a lot of money saved up and want to get rid of mortgage insurance within the first 5 years give or take. 20% equity position is needed for no mi

The biggest difference between conventional loans and FHA loans comes down to the mortgage insurance. Mortgage insurance is more expensive for FHA loans, but the trade off is a lower fixed rate than conventional loans.

On Conventional loans there is no upfront mortgage insurance like FHA, and if you have a high credit score you can possibly get a lower monthly mi premium as compared to FHA where everybody gets the same mortgage insurance premium not matter your credit score or down payment.

Lastly, FHA Mortgage insurance is for life of loan, whereas Conventional mortgage insurance or pmi it’s called, is discontinued once you reach the 80% threshold equity position of your home loan.

Again, I would not get too caught in FHA having mortgage insurance for life of loan, because most loans are only kept open a minimum of 5-7 years so a lot of times it may make sense to go with the lower rate and pay the mortgage insurance with FHA because most people don’t hold their mortgage for 30 years.

You can call or text me with your questions and we can compare the differences based on your credit score, down payment and income.

Equal Housing Lender. NMLS#:57916 http://www.nmlsconsumeraccess.org/Rates, terms, and program information are subject to change without notice. Subject to certain approvals, terms and conditions. This is not a commitment to lend.

Not part of any government lending agency and only lending in the State of Kentucky.

Looking at FHA loans vs Conventional loans can arm you with a lot of valuable information as these are the 2 most popular mortgage loan products today. Before getting to the content let’s look at some abbreviations that will need to be defined.

- PMI stands for Private Mortgage Insurance

- MIP stands for Mortgage Insurance Premium

- Credit Scores are a numerical measure of your credit worthiness, the maximum score is 850

- Debt-to-Income Ratio measures your monthly income versus your monthly obligations. A good rule of thumb is to try to be below 45%

FHA Loans vs Conventional Loans

Conventional Mortgage Benefits

- 20% down payment preferred to avoid PMI

- No upfront PMI

- 3% Down Payment Conventional Loan Option is available

- PMI expires once principal balance is less than 78%

- Houses do not have to be owner-occupied (so they can be used at rentals)

- Can purchase any condominium and townhome (no FHA regulations)

Conventional Mortgage Disadvantages

- Significant upfront investment (20% down preferred)

- Credit score of 620 required

- No Down Payment Assistance

- Down Payment must be at least 5% unless you qualify for a 3% conventional mortgage

- Harder to Qualify for a Conventional Mortgage

- No government inspection so the home can be in any quality

- Only a portion of a down payment can be a gift

- Interest rates are higher than FHA loans

Most of the disadvantages of conventional mortgages stem around qualifications and resources needed upfront. If a borrower has significant resources most of these disadvantages are of little consequence.

FHA Loan Advantages

The major advantage to going with an FHA loan is that there are much more lax credit standards you have to meet to obtain financing. Usually, FHA mortgages require a lower down payment, can work with lower credit scores, less elapsed time is needed if you have some credit problems (charge-offs, foreclosures) and you can use a non-occupant co-borrower or co-signer (who is a relative) to help you qualify for the loan. That way you can use blended ratios. Blended ratios are debt-to-income ratios that equally blend or combine the primary borrower’s income and the non-occupant co-borrower’s income and monthly payments to help get approval for the loan. Except for HomeReady (formerly Fannie Mae HomePath) mortgages, conventional loans do not allow you to use a non-occupant co-borrower.

- Government-backed program. Ideal for first-time home buyers

- Easier to obtain, lower credit scores needed and lower minimum down payment

- Down Payment minimum is 3.5%

- All of down payment can be a gift

- Down Payment Assistance Available (in some circumstances)

- No reserves required

- Minimum credit score is 500 (for 3.5% down payment)

- edition to be approved for FHA so there are less potential upfront repairs needed

- Lower interest rates than conventional mortgages

FHA Loan Disadvantages

- FHA loans require the owners to live in the home

- Mortgage Insurance Premium required if borrowers put down less than 10%

- Private Mortgage Insurance monthly cost is higher for FHA loans

- Government Licensed Inspector required to inspect home before sale can be approved

- Condominiums require FHA approval

- FHA Loans take longer to process because of government requirements and all mandated repairs have to be completed before sales can be finalized

Most of these disadvantages involve extra requirements or limits added to the process of the house (see Pros and Cons of FHA Loans). Some of these might not be disadvantages depending on one’s personal situation, but they are extra steps to note. Since FHA mortgages are a government program, more care and consideration goes into the process, which may be better in some situations.

FHA loans vs Conventional loans

There are four important numbers in deciding which loan you will go with: credit scores, down payment amount, debt-to-income, and mortgage insurance percentage rate. Conventional mortgages and FHA home loans have different limits and rates which are important to examine. They also have important differences which affect the availability of properties, the condition of the properties one wishes to buy and how your down payment can be paid. So comparing FHA loans vs Conventional loans can sometimes be a tricky endeavor.

Down Payment Requirements

- Conventional Mortgages require between 5 and 20% upfront

- In certain circumstances, down payments can be as low as 3% (Conventional 97 loan program)

- FHA Mortgages have 2 possibilities

- If Credit Score is 500-579 then 10% down payment is required (not all lenders will even go down this low)

- If Credit Score is 580+ then 3.5% down payment is required

Debt-to-Income Ratio

- Conventional Mortgages’ maximum debt-to-income ratio is 43% (hard cap)

- FHA Mortgages’ maximum debt-to-income ratio is 45%

- Soft cap as in certain circumstances this can be adjusted up to 50%

Mortgage Insurance Premium Rates

- FHA Mortgages

- If Down Payment is 10% or more the percentage is .80% MIP

- If Down Payment is less than 10% the rate is .85% MIP.

Credit Score Minimum Requirement

- Conventional Mortgage minimum credit score

- Most lenders will require between 620 and 640

- Some lenders it will be as high as 700

- FHA Mortgage minimum credit score

- Credit Score is a minimum of 500 if putting 10% down

- Credit Score is a minimum of 580 if not

These four numbers are important to know and will affect one’s decision to pursue a particular type of home loan. Knowing your combination of numbers as you are looking to buy a house will help buyers find the best loans for their particular situation.

OTHER COMPARISONS

- All sellers will take conventional mortgages and some sellers will not take FHA Loans

- People looking for short-sells won’t take FHA because FHA has a longer closing process.

- If sellers know there are FHA repairs that are needed in order to sell their house, they will not always accept FHA financing.

Thus, if one is wanting a low-risk transaction then the FHA home loan route is a better option to pursue, even though it limits your options for homes that you might wish to buy. If one is looking to fix-up a house and raise its equity quickly then a conventional loan is going to be more beneficial because there are no requirements as to the condition of the house and it’s occupied status.

DOWN PAYMENT GIFTING

- Making the Down Payments (Assistance and Gifts)

- Conventional mortgages have no assistance but can be partially fulfilled with a gift

- FHA Mortgages have loans and assistance programs available and the whole down payment can be fulfilled with a gift

In this article, we have given you the basic parameters of FHA loans vs Conventional loans. The conventional loans are for people who have a better financial track record and can handle a larger upfront cost. Because of PMI, conventional loans are cheaper in the long run if you can put enough of a down payment to get rid of PMI. However, there are no down payment assistance programs to help you reach that goal. FHA loans are for people who are looking to build their investment and in some cases may not have a great financial track record. FHA loans have lower down payment requirements and many grants/forgivable loans to help people wanting to buy a first house in which to live for at least a few years. It is important to assess your situation and decide which mortgage is going to work better for your circumstances.

CONCLUSION

Both mortgages have a lot of benefits and drawbacks because they are designed for people with different needs. This article has hopefully helped you to get a basic understanding of the different terms and conditions of different mortgage packages when looking at FHA loans vs Conventional loans. Home buying can be an emotional roller coaster and the knowledge in this article will help you navigate the various emotional struggles of home buying.

Credit Scores for Kentucky Mortgages

Credit Score Needed to Buy a House and get a Kentucky Mortgage?

Conventional Loan

• At least 3%-5% down• Closing costs will vary on which rate you choose and the lender. Typically, the higher the rate, the lesser closing costs due to the lender giving you a lender credit back at closing for over par pricing. Also, called a no-closing costs option. You have to weigh the pros and cons to see if it makes sense to forgo the lower rate and lower monthly payment for the higher rate and less closing costs.

Fico scores needed start at 620, but most conventional lenders will want a higher score to qualify for the 3-5% minimum down payment requirements Most buyers using this loan have high credit scores (over 720) and at least 5% down.

The rates are a little higher compared to FHA, VA, or USDA loan but the mortgage insurance is not for life of loan and can be rolled off when you reach 80% equity position in home. Conventional loans require 4-7 years removed from Bankruptcy and foreclosure.

Kentucky USDA Rural Housing Program

If you meet income eligibility requirements and are looking to settle in a rural area, you might qualify for the KY USDA Rural Housing program. The program guarantees qualifying loans, reducing lenders’ risk and encouraging them to offer buyers 100% loans. That means Kentucky home buyers don’t have to put any money down, and even the “upfront fee” (a closing cost for this type of loan) can be rolled into the financing.

Fico scores usually wanted for this program center around 620 range, with most lenders wanting a 640 score so they can obtain an automated approval through GUS. GUS stands for the Guaranteed Underwriting system, and it will dictate your max loan pre-approval based on your income, credit scores, debt to income ratio and assets.

They also allow for a manual underwrite, which states that the max house payment ratios are set at 29% and 41% respectively of your income.

They loan requires no down payment, and the current mortgage insurance is 1% upfront, called a funding fee, and .35% annually for the monthly mi payment. Since they recently reduced their mi requirements, USDA is one of the best options out there for home buyers looking to buy in a rural area

A rural area typically will be any area outside the major cities of Louisville, Lexington, Paducah, Bowling Green, Richmond, Frankfort, and parts of Northern Kentucky. There is a map link below to see the qualifying areas.

There is also a max household income limits with most cutoff starting at 109,500 for a family of four, and up to $136,000 for a family of five or more.

The income limits change every spring, so make sure and check to see what updated income limits are.

USDA requires 3 years removed from bankruptcy and foreclosure

There is no max USDA loan limit.

Kentucky FHA Loan

FHA loans are good for home buyers with lower credit scores and no much down, or with down payment assistance grants. FHA will allow for grants, gifts, for their 3.5% minimum investment and will go down to a 580-credit score.

The current mortgage insurance requirements are kind of steep when compared to USDA, VA, but the rates are usually good so it can counteract the high mi premiums. As I tell borrowers, you will not have the loan for 30 years, so don’t worry too much about the mi premiums.

The mi premiums are for life of loan like USDA.

FHA requires 2 years removed from bankruptcy and 3 years removed from foreclosure.

Kentucky VA Loan

VA loans are for veterans and active-duty military personnel. The loan requires no down payment and no monthly mi premiums, saving you on the monthly payment. It does have an funding fee like USDA, but it is higher starting at 2% for first time use, and 3% for second time use. The funding fee is financed into the loan, so it is not something you have to pay upfront out of pocket.

VA loans can be made anywhere, unlike the USDA restrictions, and there is no income household limit and no max loan limits in Kentucky

Most VA lenders I work with will want a 580-credit score, even though VA says in their guidelines there is no minimum score, good luck finding a lender

VA requires 2 years removed from bankruptcy or foreclosure

Clear Caviars needed to for a VA loan.

Kentucky Down Payment Assistance

This type of loan is administered by KHC in the state of Kentucky. They typically have $10,000 down payment assistance year around, that is in the form of a second mortgage that you pay back over 10 years.

Sometimes they will come to market with other down payment assistance and lower market rates to benefit lower income households with not a lot of money for down payment.

KHC offers FHA, VA, USDA, and Conventional loans with their minimum credit scores being set at 620 for all programs. The conventional loan requirements at KHC requires 660 credit score.

The max debt to income ratios is set at 40% and 50% respectively.

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com