The requirements for Kentucky FHA loans are set by HUD.

- Borrowers must have a steady employment history of the last two years within the same industry or line of work. Recent college graduates can use their transcripts to supplant the 2-year work history rule as long as it makes sense.

- Self-Employed will need a 2-year history of tax returns filed with IRS. They will take a 2-year average.

- FHA requires a 3.5% down payment. Can be gifted from a family member or from a retirement savings plan, or money saved up. Any type of cash deposits is not allowed for down payments. No exceptions to this rule!! This is one of the biggest issues I see in FHA underwriting nowadays.

- FHA loans are for primary residence occupancy. Not rental houses.

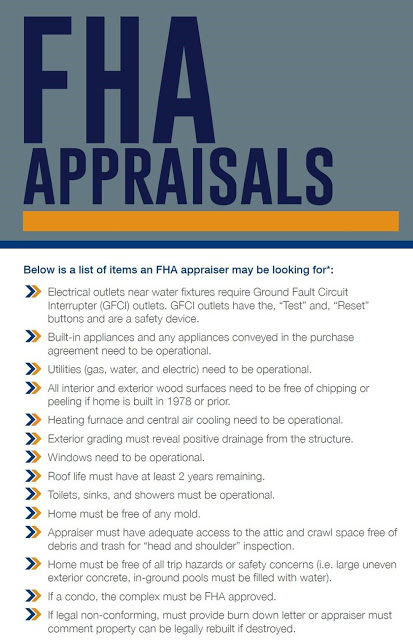

- Borrowers must have a property appraisal from an FHA-approved appraiser.

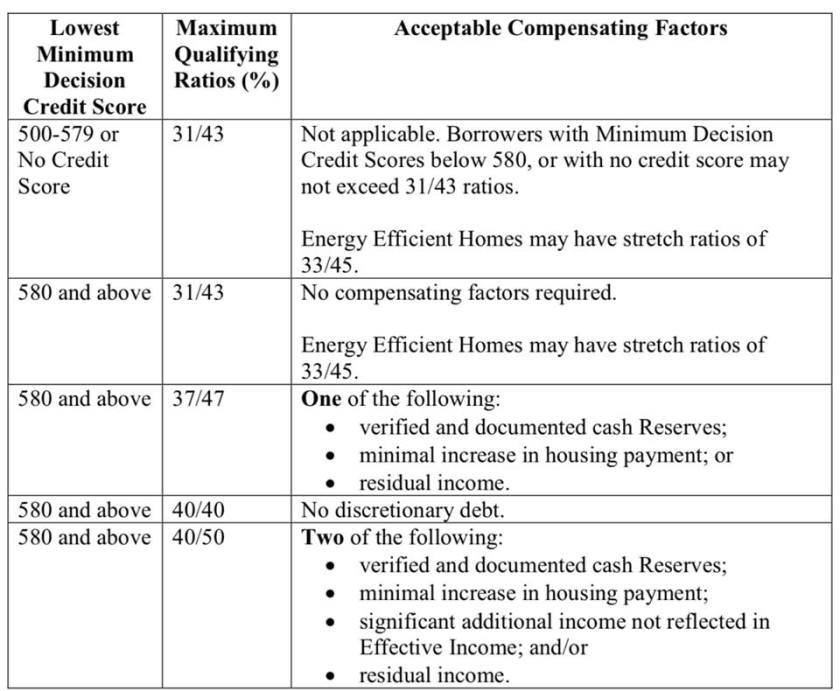

- Borrowers’ front-end ratio (mortgage payment plus HOA fees, property taxes, mortgage insurance, homeowners insurance) needs to be less than 31 percent of their gross income, typically. You may be able to get approved with as high a percentage as 43 percent. If the Automated Underwriting System gives you an Approved Eligible you can go higher on the debt ratios

- Borrowers must have a minimum credit score of 580 for maximum financing with a 3.5% down payment

- Borrowers must have a minimum credit score of 500-579 for maximum LTV of 90 percent with a minimum down payment of 10 percent. Most lenders will not go below 580 to 620 score, and very few lenders will go to 580 score. It’s best to work on getting your scores up before you apply or work with a loan officer to improve them.

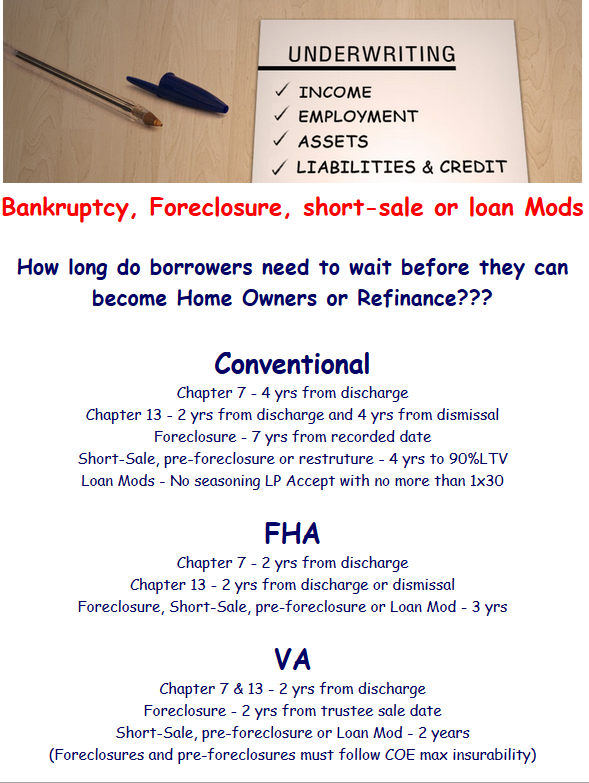

- 2 years removed from Chapter 7 is required with good pay history after bankruptcy

- 1 year removed from Chapter 13 is okay with an excellent pay history with the Chapter 13 plan and permission from the trustee. You will need to qualify with the Chapter 13 payment along with a new house payment. Again, scores will play into your loan pre-approval.

- Typically borrowers must be three years out of foreclosure and have re-established good credit. Exceptions can be made if there were extenuating circumstances and you’ve improved your credit. If you were unable to sell your home because you had to move to a new area, this does not qualify as an exception to the three-year foreclosure guideline.

- The property must be appraised by a Kentucky FHA-approved appraiser.

- The property must be safe, sound and secure, in compliance with minimum property standards as defined by the U.S. Department of Housing and Urban Development, or HUD.

- You may not have delinquent federal debt or judgments, or debt associated with past FHA loans. Caivrs Alert System will show up if you owe the government money.

Why Lenders Use CAIVRS

It is true that your CAIVRS report can help lenders to predict the risk of doing business with you, just like a traditional consumer credit report. But the primary reason lenders check your CAIVRS report is because they are generally required to do so for any applications that involve a federal loan (FHA, VA, USDA, SBA, etc.). Lenders are required to conduct a CAIVRS search because of Title 31 of the United States Code (Section 3720B) bars “delinquent federal debtors from obtaining federal loans or loan insurance guarantees.”

Kentucky FHA Loan Requirements for 2024

-

Gift Rules for Down-Payment Sources Guidelines on FHA Mortgage Programs

One of the biggest obstacles to buying a home for Americans is the down payment. There was a time when you needed a 20% down payment and a high credit score to buy a home. But in 2022, you can buy a home with average to below-average credit and low down payment in some cases. One of the most popular loan programs for these buyers if the FHA loan. A major advantage of the FHA mortgage loan is you can get approved with only a 3.5% down payment with a 580 or higher credit score. If you have a lower score than that, you need a 10% down payment.

Still, there are situations where the borrower is having trouble coming up with the down payment for the loan. What to do then? FHA guidelines do allow other options. Keep reading to learn more.

More on FHA Down Payments and Approved Sources

As we noted above, you are required to have at least a 3.5% down payment to be approved for an FHA loan. The money must be verified by the FHA-approved lender to come from an ‘approved source.’ What is an approved source, anyway? Most people get their down payment from cash reserves, investments, borrow from 401k or IRA, etc. The idea behind verifying where the money came from is to make sure the borrower did not get the down payment from a credit card or payday loan, etc.

But there are other options for your down payment. The funds also can come from a gift. The gift and the giver do need to meet FHA requirements, but this flexible guideline makes it possible to get into an FHA loan with, technically, zero money down. To determine if the down payment gift can be used or not, it is necessary to check HUD rules. According to HUD 41.55.1 Chapter 5 Section B, for the funds to be a gift, there cannot be any expected repayment of the money.

Also, FHA will scrutinize the giver of the gift. Chapter 5 of the HUD Code states the cash gift is OK if it comes from your relative; employer or labor union; close friend with a defined interest in you; charitable organization; government agency or public entity.

FHA also states who cannot give gift funds to you for the down payment. These are the seller; the real estate agent or broker on the deal; the builder or an associated entity.

Gift Terms Explained

The gift for your down payment cannot be made based upon paying it back later. You are required to get a gift letter from the person or organization. The letter should state that you are not required to pay the money back. It also should provide the contact information for the borrower, such as name, address, and phone number. Also included should be the bank account from which the funds will be sent.

The gift donor should be OK with giving a bank statement with the letter. Also, he or she should ensure that the transfer amount matches what is in the gift letter and what is deposited into your account.

FHA rules are very specific on these areas to ensure that the home buying process through FHA is fair and just. But as long as you follow the FHA rules, you should be able to get help with your down payment from a friend or relative.

Don’t Have Friends or Family Who Can Help?

Not every borrower has friends or family who can give them a gift for their down payment. But HUD lists many government programs spread throughout the country in most states that can offer down payment and closing cost help for certain borrowers.

It also is worth checking if your employer and state have employer-assisted housing. This program can help people with moderate incomes to get a loan to cover closing costs and down payment. Look up FHA in your state on Google to see what is available.

The FHA is actually not the lender. They insure the loans that are issued by FHA-approved lenders. FHA loans are gear more toward borrower’s with less than 20% down payment and credit issues in the past.

Qualifying for a FHA Loan Mortgage In Kentucky

Credit Scores and Down Payment Percentages – Each year, the rules for qualifying for these loans changes. For 2024, applicants need a minimum credit score of 580 in order to get the low down payment, which is 3.5 percent.

For those whose credit score is less than 580, they will have to come up with 10 percent for their down payment. This does not guaranteed a mortgage loan approval if you have the certain credit scores, just a the minimum required.

Compensating Factors for FHA loan Approval

The credit score is just one part of the story. The FHA will also evaluate the borrower’s bankruptcies, foreclosures, prior payment history on other debts. They will also want information on difficulties that kept the borrower from making payments on other debts in the past.

Negative strikes against qualifying for the loan include not having any credit history or a bankruptcy.

Someone with a bankruptcy will have to wait for two or more years after their bankruptcy before applying for an FHA-insured loan.

If you have late payments on debt obligations, it is best to wait until you have had a full year of on-time payments before you apply for a FHA-insured loan.

If you have had a foreclosure in the past, you may still be able to get a FHA-insured loan three years after your foreclosure. The lender will be looking at the circumstances behind the foreclosure.

If you have had any civil judgement against you for money owed, collections actions or unpaid/unresolved federal debt, the FHA-approved lender will be required by the FHA to establish that all of these outstanding issues are resolved or paid before you can go through closing.

Watch out for student loans if they are delinquent because sometime this can cause a lien against you in the form of a CAVIRS Alert with HUD

As you can see, many types of borrowers who would not be eligible for a traditional mortgage, or who would face exorbitant interest rates, will be able to qualify for a FHA-insured loan at attractive interest rates.

Employment and Income for a Kentucky FHA Loan

You must have an employment history that is steady for the last two years. Does not have to be same employer.

Your income has to be verifiable in some way, whether that be through pay stubs, your income tax returns. No bank statements or cash deposits , or undocumented income can be used for income qualifying purposes.

Debt-to-Income Ratio Requirements –

Depending on the automated underwriting system from Desktop Originator, your Debt-to-income ratio is the percentage of your income before taxes that you spend on monthly debt.

Taking into account the proposed mortgage payment as well as the other debts, the FHA requires that these debts all total less than 43 percent of your pretax income in order to qualify for the loan.

If your debt load is too high, you will struggle to pay all of your bills and mortgage expenses and care for yourself and your family.

Property Requirements for a Kentucky FHA Loan

It must be the place where you intend to reside. You must move into the home within 60 days of closing the loan. The home cannot be an investment. There will be an inspection to ensure that the home is safe and habitable.

It is really not too hard to pass FHA loans and the appraisal process.

Pros of FHA Loans –

-

New homebuyers and those who have lower credit scores or who have other blemishes on their credit history will often qualify for FHA-insured loans.

-

Even though these borrowers are considered “subprime” to a traditional lender, they will receive attractive interest rates through the FHA-insured mortgage programs.

-

The down payments required from borrowers are lower than those required by traditional mortgage lenders.

-

These loans can be combined with other forms of public assistance for lower income or new borrowers so that the borrower will not need to come up with a down payment of any kind.

Cons of FHA Loans –

-

Since the FHA is not actually the lender, and you have to go through FHA-approved lenders, you may not qualify due to stricter standards that the lender has for the loan.

-

Because you are not paying 20 percent as a down payment, the FHA requires two mortgage insurance premiums to be paid. One is an upfront premium that is 1.75 percent of the loan amount. Lenders often will allow you to make that mortgage insurance premium a part of your loan. The second is an annual mortgage insurance premium that is .45 percent or 1.05 percent. This premium is paid monthly.

FHA FINANCING

CREDIT REQUIREMENTS FOR KENTUCKY FHA FINANCING

What credit score do I need to qualify for a Kentucky FHA loan is one of the most common questions I hear from Kentucky homebuyers?

The short answer is you must have a minimum credit score of 500 to be eligible for an FHA loan in Kentucky. Anything lower than 500 disqualifies you from consideration for an FHA loan.

There are two sets of credit score requirements for a Kentucky FHA Loan

One important thing to understand is that the Federal Housing Administration (FHA) does not lend money directly to home buyers. You will fill out an application with a regular lender just as you would if you were applying for any other type of mortgage. What the FHA does is ensure your loan to help protect the lender in case you default.

You will be required not only to meet the FHA guidelines to qualify for a loan but also meet any additional qualifications required by the lender. This means there are two sets of requirements you have to meet with your credit score.

1. The first set of requirements comes from the Department of Housing and Urban Development (HUD). HUD oversees the FHA and determines what a borrower’s minimum eligibility requirements will be to obtain an FHA loan.

2. The second set of requirements comes from the mortgage lender. The mortgage lender has the right to add its requirements to those mandated by HUD.

What HUD requires of borrowers to be eligible for an FHA loan

The HUD Handbook 4000.1 includes the official guidelines when it comes to the FHA mortgage insurance program.

Borrowers with credit scores from 500 to 579 are eligible for a 90% loan with 10% down.

Individuals with credit scores below 500 are not eligible for the FHA program.

What lenders may require of borrowers to be eligible for an Kentucky FHA loan

Lenders have the right to add requirements over and above the minimum requirements of HUD. These additional requirements are called overlays. Your lender may or may not require them.

This is not something that should come as a surprise to you, however. Requiring a credit score of 580 to 620 is not unusual. In addition to your credit score, you must have a manageable debt level that lenders are comfortable with and enough income to repay your loan.

-

-

Joel Lobb (NMLS#57916)

Senior Loan OfficerAmerican Mortgage Solutions, Inc.10602 Timberwood Circle Suite 3

#fhaloans #fhaloan #fha #conventionalloans #conventionalmortgage #kentuckymortgage #louisville #mortgage #homeloan #firsttimehomebuyers #khcloan #fhaloanky

#mortgagebroker #mortgagelender #homeloan