Category: 620 credit score FHA loan

Qualifying for an FHA Loan in Kentucky

When it comes to buying a home in Kentucky, FHA loans are a popular choice for many first-time homebuyers due to their flexible qualifying criteria. If you’re considering an FHA loan in the Bluegrass State, understanding the key qualifying factors is crucial. Here’s a comprehensive guide to the criteria you need to know: Understanding these … Continue reading “Qualifying for an FHA Loan in Kentucky”

When it comes to buying a home in Kentucky, FHA loans are a popular choice for many first-time homebuyers due to their flexible qualifying criteria. If you’re considering an FHA loan in the Bluegrass State, understanding the key qualifying factors is crucial. Here’s a comprehensive guide to the criteria you need to know:

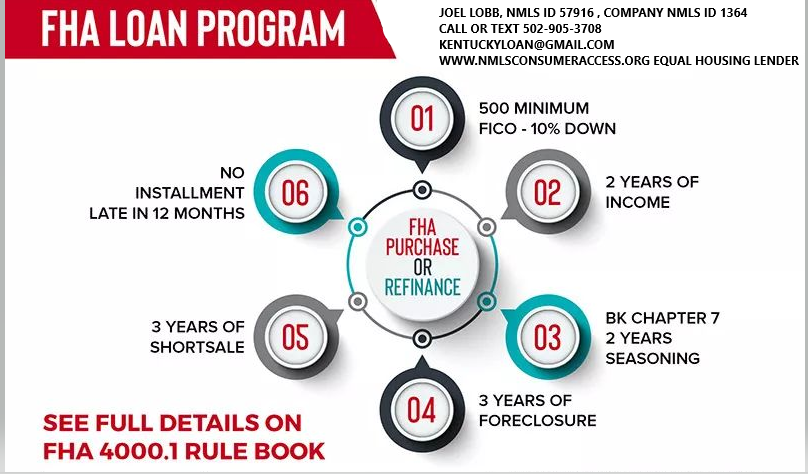

- Credit Score Requirements:

- FHA loans are known for accommodating borrowers with lower credit scores. While the minimum required credit score can vary, typically, a credit score of 580 or higher is needed to qualify for the minimum down payment of 3.5%. However, borrowers with credit scores between 500 and 579 may still be eligible with a higher down payment, usually around 10%.

- Down Payment:

- The minimum down payment for an FHA loan in Kentucky is 3.5% of the home’s purchase price. This is advantageous for buyers who may not have substantial savings for a larger down payment, making homeownership more accessible.

- Work History:

- Lenders typically look for a steady 2 year employment history when considering FHA loan applications. A consistent work history, preferably with the same employer or within the same field, helps demonstrate financial stability and the ability to repay the loan.

- Debt-to-Income Ratio (DTI):

- The debt-to-income ratio is a crucial factor in mortgage approval. For FHA loans, the maximum allowable DTI ratio is typically around 40% to 45% of your gross monthly income and can go higher up to 56% with good credit scores, large down payment or shorter term loan although lenders may consider higher ratios in certain cases if compensating factors are present.

- Bankruptcy and Foreclosure:

- FHA loans have lenient guidelines regarding bankruptcy and foreclosure. Generally, borrowers with a past bankruptcy may qualify for an FHA loan after two years if they have re-established good credit and demonstrated responsible financial behavior. For foreclosures, the waiting period is usually three years.

- Mortgage Term:

- FHA loans offer various mortgage term options, including 15-year and 30-year fixed-rate loans. The choice of term depends on your financial goals and ability to manage monthly payments.

- Occupancy: Primary residences not for rental properties

- Mortgage Insurance on the loan for life of loan. Larger down payments and shorter terms will reduce the upfront mi and monthly mi premiums

- can be used for refinances, not only for purchases.

- Max FHA loan in Kentucky is $498,257. This changes every year

- No income limits nor property restrictions on where home is located

- Can close within 30 days typically with good appraisal and title work

Understanding these qualifying criteria can help you navigate the FHA loan application process in Kentucky more effectively. Working with an experienced mortgage professional can also provide valuable guidance and assistance tailored to your specific financial situation and homeownership goals.

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS 57916 | Company NMLS #1364/MB73346135166/MBR1574

NMLS ID# 57916, (www.nmlsconsumeraccess.org).

Kentucky home loan credit scores and the minimum requirements for FHA, VA, USDA, and KHC mortgage loans in Kentucky.

Kentucky home loan credit scores and the minimum requirements for FHA, VA, USDA, and KHC mortgage loans in Kentucky.

Understanding Credit Scores for Kentucky Mortgage Loan Approval: Insights by Joel Lobb, Mortgage Broker

Are you considering applying for a mortgage loan in Kentucky but unsure about the credit score requirements? Joel Lobb, a trusted mortgage broker, provides valuable insights into credit scores and the minimum requirements for FHA, VA, USDA, and KHC mortgage loans in Kentucky. Let’s delve into the details and explore how credit scores impact your loan approval.

Kentucky Credit Scores and Kentucky Mortgage Approval

Your credit score plays a crucial role in determining your eligibility for a mortgage loan in Kentucky. Kentucky Mortgage Lenders use credit scores to assess your creditworthiness and evaluate the risk of lending to you. Different loan programs may have varying credit score requirements, so understanding these requirements is essential for prospective homebuyers.

Credit Score Models and Minimum Requirements

Here’s a chart illustrating the difference in credit score models and the minimum credit scores required for FHA, VA, USDA, and KHC mortgage loans in Kentucky:

| Loan Program | Credit Score Model | Minimum Credit Score |

|---|---|---|

| FHA Loan |

FICO® Score 2: Mortgage lenders get this version of the FICO® Score from Experian. FICO® Score 4: Mortgage lenders get this version of the FICO® Score from TransUnion. FICO® Score 5: Mortgage lenders obtain this version of the FICO® Score from Equifax. |

500 to 580 –If less than 580, you will need 10% down payment and if over 580 or higher, 3.5% minimum down payment |

| VA Loan

Equifax. |

FICO® Score 2: Mortgage lenders get this version of the FICO® Score from Experian. FICO® Score 4: Mortgage lenders get this version of the FICO® Score from TransUnion. FICO® Score 5: Mortgage lenders obtain this version of the FICO® Score from Equifax. |

No minimum score but most VA Lenders will want a 620 or higher |

| USDA Loan |

FICO® Score 2: Mortgage lenders get this version of the FICO® Score from Experian. FICO® Score 4: Mortgage lenders get this version of the FICO® Score from TransUnion. FICO® Score 5: Mortgage lenders obtain this version of the FICO® Score from Equifax. |

No minimum score, but most lenders will want a 640 or higher |

| KHC Mortgage Loan |

FICO® Score 2: Mortgage lenders get this version of the FICO® Score from Experian. FICO® Score 4: Mortgage lenders get this version of the FICO® Score from TransUnion. FICO® Score 5: Mortgage lenders obtain this version of the FICO® Score from Equifax. |

KHC requires a minimum 620 credit score for FHA, VA, USDA and 660 for Conventional loan programs |

Key Insights

-

Kentucky FHA Loans: Kentucky FHA loans are known for their lenient credit score requirements, making them accessible to borrowers with lower credit scores. However, a minimum score of 500 to 580 is typically required, depending on the down payment.

-

Kentucky VA Loans: VA loans offer flexible credit score requirements, while on paper VA states they don’t require a minimum score to insure the mortgage loan, most lenders preferring a FICO score of 620 or higher. Veterans, active-duty service members, and eligible spouses can benefit from VA loan options.

-

Kentucky USDA Loans: USDA loans are designed for rural homebuyers and require no minimum FICO score , but most lenders will want a credit score of 640 or higher. These loans offer zero down payment options for eligible properties.

-

KHC Mortgage Loans: Kentucky Housing Corporation (KHC) mortgage loans may vary in credit score requirements depending on the lender. It’s essential to work with a knowledgeable mortgage broker like Joel Lobb to understand specific lender guidelines. KHC requires a minimum 620 credit score for FHA, VA, USDA and 660 for Conventional loan programs

Expert Guidance from Joel Lobb

Joel Lobb specializes in helping clients navigate the mortgage process, including understanding credit score requirements. With Joel Lobb’s expertise and personalized guidance, you can improve your credit score, explore loan options, and increase your chances of mortgage loan approval.

Contact Joel Lobb today to learn more about credit scores and mortgage loan approval in Kentucky. Start your journey towards homeownership with confidence and expert assistance.

This article provides valuable information about credit scores required for mortgage loan approval in Kentucky, along with a chart illustrating the minimum requirements for FHA, VA, USDA, and KHC mortgage loans. Joel Lobb’s expertise and guidance add credibility and assurance to prospective homebuyers seeking mortgage financing.

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS 57916 | Company NMLS #1364/MB73346135166/MBR1574

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

NMLS ID# 57916, (www.nmlsconsumeraccess.org).

Credit score requirements for FHA, VA, USDA, and Fannie Mae loans in Kentucky

Understanding Credit Score Requirements for Mortgage Loans in Kentucky

Are you considering buying a home in the beautiful state of Kentucky? Securing a mortgage loan is a crucial step in the homebuying process, and one of the key factors lenders evaluate is your credit score. Understanding the credit score requirements for mortgage loan approval in Kentucky can help you prepare and improve your chances of securing financing for your dream home.

Importance of Credit Scores

Your credit score is a numerical representation of your creditworthiness based on your credit history. Lenders use this score to assess the risk of lending to you. A higher credit score typically indicates lower risk to lenders, making you more likely to qualify for a mortgage loan and secure better terms and interest rates.

Credit Score Requirements in Kentucky

While specific credit score requirements can vary among lenders and mortgage programs, there are some general guidelines to consider when applying for a mortgage loan in Kentucky.

- Conventional Loans: Conventional mortgage loans are not insured or guaranteed by the government. Many lenders prefer borrowers to have a credit score of at least 620 to qualify for a conventional loan. However, some lenders may require higher scores, especially for competitive interest rates.

- FHA Loans: The Federal Housing Administration (FHA) offers loans with more lenient credit score requirements compared to conventional loans. In Kentucky, borrowers may be eligible for an FHA loan with a credit score as low as 500, provided they can make a 10% down payment. A credit score of 580 or higher may qualify for a lower down payment option of 3.5%.

- VA Loans: If you’re a veteran, active-duty service member, or eligible spouse, you may qualify for a VA loan guaranteed by the Department of Veterans Affairs. VA loans typically have more flexible credit score requirements, and some lenders may consider borrowers with credit scores below 620.

- USDA Loans: The U.S. Department of Agriculture (USDA) offers loans to eligible rural and suburban homebuyers with low to moderate incomes. Credit score requirements for USDA loans in Kentucky can vary, but many lenders prefer scores of 640 or higher.

Tips for Improving Your Credit Score

If your credit score is below the desired threshold for a mortgage loan, don’t despair. There are steps you can take to improve your creditworthiness over time:

- Check Your Credit Report: Obtain a free copy of your credit report from each of the three major credit bureaus—Equifax, Experian, and TransUnion—and review them for errors or discrepancies.

- Pay Bills on Time: Your payment history is one of the most significant factors affecting your credit score. Make sure to pay all your bills, including credit cards, loans, and utilities, on time.

- Reduce Credit Card Balances: Aim to keep your credit card balances low relative to your credit limits. High credit utilization can negatively impact your credit score.

- Avoid Opening New Credit Accounts: While having a mix of credit accounts can be beneficial, opening multiple new accounts within a short period can lower your credit score.

Conclusion

In Kentucky, credit score requirements for mortgage loans can vary depending on the type of loan and lender you choose. While higher credit scores generally improve your chances of loan approval and favorable terms, there are loan programs available for borrowers with less-than-perfect credit.

Before applying for a mortgage loan, it’s essential to review your credit report, understand your credit score, and take steps to improve it if necessary. By demonstrating responsible financial behavior and maintaining a good credit history, you can increase your likelihood of securing a mortgage loan and achieving your homeownership goals in Kentucky.