Category: Frequently Asked Questions

Kentucky Conventional Loan versus Kentucky FHA Loan comparison chart

This content discusses the credit score requirements, down payment options, and mortgage insurance for Kentucky Conventional and FHA Loans. It also outlines bankruptcy timelines for eligibility and provides contact information for Joel Lobb, a Senior Loan Officer. The disclaimer emphasizes that loan approvals are subject to various qualifications and conditions, and the content is not endorsed by any government agency.

Kentucky FHA Loans are good for borrowers who have the following:

• Credit scores less than 680.

• Less than 5% down payment and no reserves to use.

• Borrowers with past foreclosures between 3 and 7 years old.

• Borrowers with past short sales between 2 and 4 years old.

• Borrowers who need a gift for the down payment and/or closing costs, prepaid taxes and

insurance.

The FHA Mortgage Insurance premium is a premium that exists for the FHA Loan that is

paid up front and monthly by the homebuyer. This premium protects the lender should the

buyer default. They vary per state and per type of loan Kentucky home buyers qualify for. In Kentucky, upfront mortgage insurance premiums are 1.75%.

Below are the rates per type of loan:

• 15-Year Fixed with down payment more than 10%: .45%

• 15-Year Fixed with down payment less than 10%: .70%

• 30-Year Fixed with down payment more than 5%: .80%

• 30-Year Fixed with down payment less than 5%: .85%

Kentucky Conventional loans are usually reserved for the following:

• Credit scores greater than 680

• Greater than or equal to 5% down payment with reserves

• Borrowers with past foreclosures over 7 years old.

• Borrowers with past short sales between 5-7 years old.

• Borrowers who have a lot of money saved up and want to get rid of mortgage insurance within the first 5 years give or take. 20% equity position is needed for no mi

The biggest difference between conventional loans and FHA loans comes down to the mortgage insurance. Mortgage insurance is more expensive for FHA loans, but the trade off is a lower fixed rate than conventional loans.

On Conventional loans there is no upfront mortgage insurance like FHA, and if you have a high credit score you can possibly get a lower monthly mi premium as compared to FHA where everybody gets the same mortgage insurance premium not matter your credit score or down payment.

Lastly, FHA Mortgage insurance is for life of loan, whereas Conventional mortgage insurance or pmi it’s called, is discontinued once you reach the 80% threshold equity position of your home loan.

Again, I would not get too caught in FHA having mortgage insurance for life of loan, because most loans are only kept open a minimum of 5-7 years so a lot of times it may make sense to go with the lower rate and pay the mortgage insurance with FHA because most people don’t hold their mortgage for 30 years.

You can call or text me with your questions and we can compare the differences based on your credit score, down payment and income.

Equal Housing Lender. NMLS#:57916 http://www.nmlsconsumeraccess.org/Rates, terms, and program information are subject to change without notice. Subject to certain approvals, terms and conditions. This is not a commitment to lend.

Not part of any government lending agency and only lending in the State of Kentucky.

Looking at FHA loans vs Conventional loans can arm you with a lot of valuable information as these are the 2 most popular mortgage loan products today. Before getting to the content let’s look at some abbreviations that will need to be defined.

- PMI stands for Private Mortgage Insurance

- MIP stands for Mortgage Insurance Premium

- Credit Scores are a numerical measure of your credit worthiness, the maximum score is 850

- Debt-to-Income Ratio measures your monthly income versus your monthly obligations. A good rule of thumb is to try to be below 45%

FHA Loans vs Conventional Loans

Conventional Mortgage Benefits

- 20% down payment preferred to avoid PMI

- No upfront PMI

- 3% Down Payment Conventional Loan Option is available

- PMI expires once principal balance is less than 78%

- Houses do not have to be owner-occupied (so they can be used at rentals)

- Can purchase any condominium and townhome (no FHA regulations)

Conventional Mortgage Disadvantages

- Significant upfront investment (20% down preferred)

- Credit score of 620 required

- No Down Payment Assistance

- Down Payment must be at least 5% unless you qualify for a 3% conventional mortgage

- Harder to Qualify for a Conventional Mortgage

- No government inspection so the home can be in any quality

- Only a portion of a down payment can be a gift

- Interest rates are higher than FHA loans

Most of the disadvantages of conventional mortgages stem around qualifications and resources needed upfront. If a borrower has significant resources most of these disadvantages are of little consequence.

FHA Loan Advantages

The major advantage to going with an FHA loan is that there are much more lax credit standards you have to meet to obtain financing. Usually, FHA mortgages require a lower down payment, can work with lower credit scores, less elapsed time is needed if you have some credit problems (charge-offs, foreclosures) and you can use a non-occupant co-borrower or co-signer (who is a relative) to help you qualify for the loan. That way you can use blended ratios. Blended ratios are debt-to-income ratios that equally blend or combine the primary borrower’s income and the non-occupant co-borrower’s income and monthly payments to help get approval for the loan. Except for HomeReady (formerly Fannie Mae HomePath) mortgages, conventional loans do not allow you to use a non-occupant co-borrower.

- Government-backed program. Ideal for first-time home buyers

- Easier to obtain, lower credit scores needed and lower minimum down payment

- Down Payment minimum is 3.5%

- All of down payment can be a gift

- Down Payment Assistance Available (in some circumstances)

- No reserves required

- Minimum credit score is 500 (for 3.5% down payment)

- edition to be approved for FHA so there are less potential upfront repairs needed

- Lower interest rates than conventional mortgages

FHA Loan Disadvantages

- FHA loans require the owners to live in the home

- Mortgage Insurance Premium required if borrowers put down less than 10%

- Private Mortgage Insurance monthly cost is higher for FHA loans

- Government Licensed Inspector required to inspect home before sale can be approved

- Condominiums require FHA approval

- FHA Loans take longer to process because of government requirements and all mandated repairs have to be completed before sales can be finalized

Most of these disadvantages involve extra requirements or limits added to the process of the house (see Pros and Cons of FHA Loans). Some of these might not be disadvantages depending on one’s personal situation, but they are extra steps to note. Since FHA mortgages are a government program, more care and consideration goes into the process, which may be better in some situations.

FHA loans vs Conventional loans

There are four important numbers in deciding which loan you will go with: credit scores, down payment amount, debt-to-income, and mortgage insurance percentage rate. Conventional mortgages and FHA home loans have different limits and rates which are important to examine. They also have important differences which affect the availability of properties, the condition of the properties one wishes to buy and how your down payment can be paid. So comparing FHA loans vs Conventional loans can sometimes be a tricky endeavor.

Down Payment Requirements

- Conventional Mortgages require between 5 and 20% upfront

- In certain circumstances, down payments can be as low as 3% (Conventional 97 loan program)

- FHA Mortgages have 2 possibilities

- If Credit Score is 500-579 then 10% down payment is required (not all lenders will even go down this low)

- If Credit Score is 580+ then 3.5% down payment is required

Debt-to-Income Ratio

- Conventional Mortgages’ maximum debt-to-income ratio is 43% (hard cap)

- FHA Mortgages’ maximum debt-to-income ratio is 45%

- Soft cap as in certain circumstances this can be adjusted up to 50%

Mortgage Insurance Premium Rates

- FHA Mortgages

- If Down Payment is 10% or more the percentage is .80% MIP

- If Down Payment is less than 10% the rate is .85% MIP.

Credit Score Minimum Requirement

- Conventional Mortgage minimum credit score

- Most lenders will require between 620 and 640

- Some lenders it will be as high as 700

- FHA Mortgage minimum credit score

- Credit Score is a minimum of 500 if putting 10% down

- Credit Score is a minimum of 580 if not

These four numbers are important to know and will affect one’s decision to pursue a particular type of home loan. Knowing your combination of numbers as you are looking to buy a house will help buyers find the best loans for their particular situation.

OTHER COMPARISONS

- All sellers will take conventional mortgages and some sellers will not take FHA Loans

- People looking for short-sells won’t take FHA because FHA has a longer closing process.

- If sellers know there are FHA repairs that are needed in order to sell their house, they will not always accept FHA financing.

Thus, if one is wanting a low-risk transaction then the FHA home loan route is a better option to pursue, even though it limits your options for homes that you might wish to buy. If one is looking to fix-up a house and raise its equity quickly then a conventional loan is going to be more beneficial because there are no requirements as to the condition of the house and it’s occupied status.

DOWN PAYMENT GIFTING

- Making the Down Payments (Assistance and Gifts)

- Conventional mortgages have no assistance but can be partially fulfilled with a gift

- FHA Mortgages have loans and assistance programs available and the whole down payment can be fulfilled with a gift

In this article, we have given you the basic parameters of FHA loans vs Conventional loans. The conventional loans are for people who have a better financial track record and can handle a larger upfront cost. Because of PMI, conventional loans are cheaper in the long run if you can put enough of a down payment to get rid of PMI. However, there are no down payment assistance programs to help you reach that goal. FHA loans are for people who are looking to build their investment and in some cases may not have a great financial track record. FHA loans have lower down payment requirements and many grants/forgivable loans to help people wanting to buy a first house in which to live for at least a few years. It is important to assess your situation and decide which mortgage is going to work better for your circumstances.

CONCLUSION

Both mortgages have a lot of benefits and drawbacks because they are designed for people with different needs. This article has hopefully helped you to get a basic understanding of the different terms and conditions of different mortgage packages when looking at FHA loans vs Conventional loans. Home buying can be an emotional roller coaster and the knowledge in this article will help you navigate the various emotional struggles of home buying.

5 Things to Know about buying a house and getting a Mortgage Loan approval in Kentucky for 2023

5 Things to Know about buying a house and getting a Mortgage Loan approval in Kentucky for 2023

1. Do Mortgage Rates Change Daily?

Just like the gas prices at the pump, mortgage rates can change daily or throughout the day. Typically mortgage rates are published at 10-11 am daily by most lenders and you can lock up through the close of business which is usually around 6-7 PM. Mortgage rates can change up or down throughout the day based on various financial, economics, and geopolitical news in the US Financial markets and World markets. Generally speaking, good economic news is bad for rates and vice versa, bad economic news is good for mortgage rates.

The good news is this: Once you find a home and get it under contract, you can lock your mortgage loan rate. Typically it takes about 30-45 days to close a mortgage loan in Kentucky, so the typical lock is for 30-60 days. If rates get better you may be able to negotiate a better rate with your lender, but they usually have to improve by at least 25 basis points (.25) to do that. Not all lenders offer this option. The longer you lock the loan, the greater the costs. It is usually free to lock in a loan for up to 90 days without having to pay a fee.

What a lot of lenders are experiencing now is that some loans don’t close on time for various reasons. You can always extend the lock on the loan but it will costs you usually .125 basis points to do so. If you let the lock expire on the loan, then you have to take worse case pricing on that day when you go to relock. It is usually best to extend the lock on your loan.

2. What kind of Credit Score Do I need to qualify?

When applying for a mortgage loan, lenders will pull what they call a “tri-merge” credit report which will show three different fico scores from Trans union, Equifax, and Experian. The lenders will throw out the high and low score and take the “middle score” For example, if you had a 614, 610, and 629 score from the three main credit bureaus, your qualifying score would be 614. Most lenders will want at least two scores. So if you only have one score, you may not qualify. Lenders will have to pull their own credit report and scores so if you had it ran somewhere else or saw it on a website or credit card you may own, it will not matter to the lender, because they have to use their own credit report and scores.

Most lenders will pull your credit report for free nowadays so this should not be a big deal as long as your scores are high enough.

The Secondary Market of Mortgage loans offered by FHA, VA, USDA, Fannie Mae, and KHC all have their minimum fico score requirements and lenders will create overlays in addition to what the Government agencies will accept, so even if on paper FHA says they will go down to 580 or 500 in some cases on fico scores, very few lenders will go below the 620 threshold.

If you have low fico scores it may make sense to check around with different lenders to see what their minimum fico scores are for loans.

The lenders I currently deal with have the following fico cutoffs for credit scores:

FHA–580 minimum score

VA—-580 minimum score

Fannie Mae–620 minimum score

USDA–620 minimum score

KHC with Down Payment Assistance –620 minimum score.

As you can see, 580-620 is the minimum score with most lenders for a FHA, VA, or Fannie Mae loan, is required for the no down payment programs offered by USDA for Kentucky for First Time Home Buyers wanting to go no money down.

3. What are the down payment requirements?

The most popular programs for Kentucky First Time Home Buyers usually involves one of the following housing programs outlined in bold below:

FHA:

FHA will allow a home buyer to purchase a house with as little as 3.5% down. If your credit scores are low, say 680 and below, a lot of times it makes sense to go FHA because everyone pays the same mortgage insurance premiums no matter what your score is, and the down payment can be gifted to you. Meaning you really don’t have to have any skin into the game when it comes to down payment.

They even allow down payment assistance for down payment requirements of 3.5% through eligible parties like Kentucky Housing, Welcome Home Grants and Louisville KY and Covington Kentucky Down Payment Grants.

Lastly, FHA will allow for higher debt to income ratios with sometimes getting loan pre-approvals up to 55% of your total gross monthly income. So if you have a debt to income ratio of over 50%, Fannie Mae will not do the loan and USDA usually likes their debt to income ratios no more than 45%.

Think back to the last time you financed a purchase — be it a home, automobile, or what have you… You may remember having heard the term “debt-to-income ratio.” Today I want to spend some time going over exactly what this ratio is, and to also touch on how it can effect your personal finances.

4. What is your debt-to-income ratio?

Commonly referred to as your “DTI,” your debt-to-income ratio is a personal finance benchmark that relates your monthly debt payments to your monthly gross income.

As an example… Let’s say that your gross monthly salary is $5,000 and you are spending $2,800 of it toward monthly debt payments. In that case, your DTI would be an unhealthy 56%.

This version of your DTI is sometimes referred to as your “back-end” DTI. This is often broken down further to give a front-end debt-to-income ratio, which is a component of your back-end DTI.

How to calculate your front-end DTI for a Kentucky Mortgage Loan Approval

Your front-end DTI is calculated by dividing your monthly housing costs by your monthly gross income. Front-end DTI for renters is simply the amount paid in rent, whereas for homeowners it is the sum of mortgage principal, interest, property taxes, and home insurance (i.e., your PITI) divided by gross monthly income.

From above, if that $2,800 in debt payments is attributable to $1,500 in housing costs and $1,300 in non-housing costs, then your front-end DTI is $1,500/$5,000 = 30% (and your back-end ratio is still 56%, as calculated above).

Fannie Mae:

Fannie Mae requires just 3% down with their new Home Possible Program, but if you use their traditional mortgage loan, then 5% is the Fannie Mae Standard. Fannie Mae will go down 620 score, but if your scores are below 680, I would look seriously at the FHA loan program because Fannie Mae has steep increases to the interest rate and the mortgage insurance premiums if your scores are low.

A couple of good things about Fannie Mae is that you can buy a larger priced home and have a large loan amount due to FHA only allowing most Kentucky Home Buyers a maximum mortgage loan amount of $356,000 for a max FHA loan and $545,000 for Fannie Mae Conventional loans in Kentucky for 2020.

Lastly when it comes to mortgage insurance, FHA mortgage insurance premiums are for life of loan while Fannie Mae mortgage insurance premiums drop off when you develop 80% equity position in your house.

But as a tell most people, nobody has a loan for 30 years, and the average mortgage is either refinanced or home sold within the first 5-7 years.

VA Loans-

VA loans offer eligible Veterans and Active Duty Personnel to buy a home going no money down with no monthly mortgage insurance. This is probably the best no money down loan out there since the rates are traditionally very low on comparison to other government insured mortgages and no monthly mortgage insurance. The VA loan can be used anywhere in the state of Kentucky with the maximum VA loan limit being removed for 2021

USDA Loans-

USDA loans offer people buying a home in rural areas (typically towns of $20k or less) to buy a home going zero down. You cannot currently own another home and there is household income limits of $90,200 for a household family of four, and up to $119,300 for a household of five or more. You search USDA website for eligible areas and household income limits below at the yellow highlighted link :

KHC or Kentucky Housing-

Kentucky First Time Home Buyers typically use KHC for their down payment assistance. KHC currently offers $10,000 for down payment assistance and sometimes throughout the year they will offer low mortgage rates on their mortgage revenue bond program.

The down payment assistance usually never runs out because you have to pay it back in the form of a second mortgage. It helps a lot of home buyers that want to buy in urban areas that cannot utilizer the USDA program in rural areas. Most of the time the first mortgage is a FHA loan tied with the 2nd mortgage fore down payment assistance. All KHC programs require a 620 score and rates are locked for 45 days.

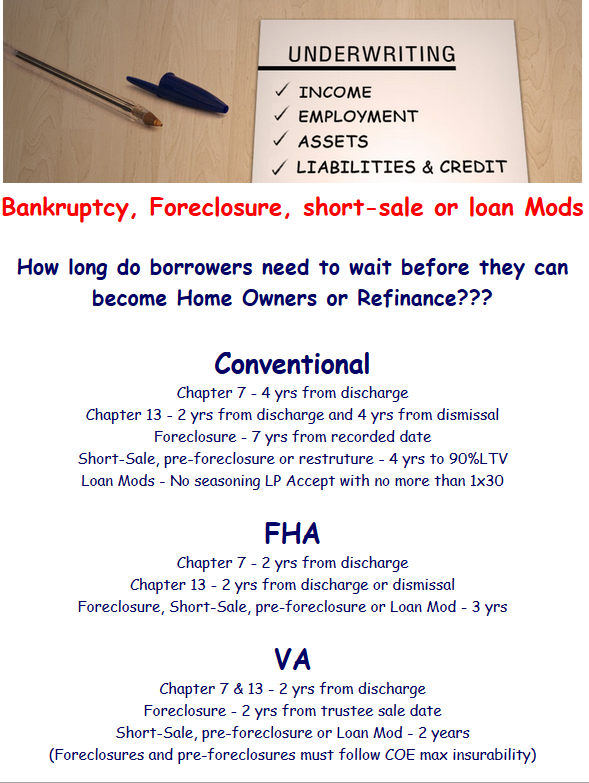

5. What if I have had a bankruptcy or foreclosure in the past?

FHA and VA are the easiest on previous bankruptcies. FHA and VA both require 2 years removed from the discharge date on a Chapter 7. If you are in the middle of a Chapter 13, FHA will allow for financing with a 12 month clean history payment to the Chapter 13 courts, and with trustee permission.

VA requires 2 years removed from a foreclosure (sheriff sale date of home) and FHA requires 3 years.

USDA requires 3 years removed from both a foreclosure and bankruptcy, but on the foreclosure they do not go off the sale date. This may save you a little time if you had a previous foreclosure.

Fannie Mae (Conventional Loan)

Fannie Mae is by far the strictest. They require 4-7 years out of a foreclosure or bankruptcy

If you have questions about qualifying as first time home buyer in Kentucky, please call, text, email or fill out free prequalification below for your next mortgage loan pre-approval.

Joel Lobb

Senior Loan Officer

(NMLS#57916)

Text or call phone: (502) 905-3708

email me at kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the views of my employer. Not all products or services mentioned on this site may fit all people

CONFIDENTIALITY NOTICE: This message is covered by the Electronic Communications Privacy Act, Title 18, United States Code, §§ 2510-2521. This e-mail and any attached files are deemed privileged and confidential, and are intended solely for the use of the individual(s) or entity to whom this e-mail is addressed. If you are not one of the named recipient(s) or believe that you have received this message in error, please delete this e-mail and any attached files from all locations in your computer, server, network, etc., and notify the sender IMMEDIATELY at 502-327-9770. Any other use, re-creation, dissemination, forwarding, or copying of this e-mail and any attached files is strictly prohibited and may be unlawful. Receipt by anyone other than the named recipient(s) is not a waiver of any attorney-client, work product, or other applicable privilege. E-mail is an informal method of communication and is subject to possible data corruption, either accidentally or intentionally. Therefore, it is normally inappropriate to rely on legal advice contained in an e-mail without obtaining further confirmation of said advice.

Kentucky FHA Mortgage Loans with Private Flood Insurance

Kentucky FHA Mortgage Loans with Private Flood Insurance

HUD INCREASES FLOOD INSURANCE OPTIONS FOR KENTUCKY HOMEOWNERS WITH KENTUKY FHA MORTGAGES LIVING IN FLOOD AREAS

Federal Housing Administration to allow private flood insurance policies on insured single-family mortgages in special flood hazard areas

WASHINGTON – The U.S. Department of Housing and Urban Development (HUD), through the Federal Housing Administration (FHA), is announcing today that effective December 21, 2022, it will allow homeowners with FHA-insured mortgage financing to obtain flood insurance policies that conform to FHA requirements from private insurance providers. The change was announced through a final rule published in the Federal Register today and in a companion Mortgagee Letter, also published today, that provides implementation guidance for FHA-approved lenders.

FHA requires that insured mortgages for properties in Federal Emergency Management Agency (FEMA)-designated Special Flood Hazard Areas (SFHAs) have flood insurance. Previously, only flood insurance obtained through the National Flood Insurance Program (NFIP) was permissible for FHA-insured mortgages, which limited choices for consumers.

“Today, HUD is increasing the flood insurance choices available to individuals and families with FHA-insured loans in areas that FEMA has designated to be at special risk for flooding,” said HUD Secretary Marcia L. Fudge. “Flood insurance is required to ensure families and individuals are prepared if disaster strikes. Increasing consumer options for this important protection is one way we are building more resilient communities in the face of climate change.”

“We know borrowers face affordability challenges right now, yet a flood can be devastating to a family who is not properly insured,” said Federal Housing Commissioner Julia Gordon. “The choice to select a private flood insurance option may enable some borrowers to obtain policies that are less expensive or provide enhanced coverage.”

As part of its implementation, as of December 21, 2022, FHA will require lenders to provide detailed flood insurance coverage information when electronically submitting mortgages for FHA insurance on properties in SFHAs. This data collection is an objective included in HUD’s Climate Action Plan and will allow FHA to capture and analyze flood insurance information on mortgages in its portfolio at a more granular level than has been possible previously.

Ensuring that borrowers are protected against flood risk is a key component of HUD’s Climate Action Plan. In 2021, HUD released its Climate Action Plan in response to President Biden’s Executive Order on Tackling the Climate Crisis at Home and Abroad. HUD has been implementing this broad approach to the climate crisis that reduces climate pollution; increases resilience to the impacts of climate change; protects public health; delivers environmental justice; and spurs well-paying union jobs and economic growth. The action today further guides the integration of climate resilience and environmental justice into HUD’s core programs and policies. For more information about HUD’s work to advance sustainable communities and address climate change, visit hud.gov/climate.

#fha #fhaloans #fhaloan #floodinsurance #mortgage #homeloan #homebuying #homebuyingtips