Are you considering a home purchase in Kentucky ? If so, then a Kentucky FHA loan might be for you. This Kentucky FHA Mortgage guide will provide you with all the FHA loan information you need to buy a home in Kentucky using the FHA loan program

What Is A Kentucky FHA Loan?

If you’re looking to buy a home but have limited funds for a down payment or a lower credit score, then an Kentucky FHA loan might be a good option for you. This is a type of a Kentucky mortgage insured by the Federal Housing Administration (FHA), which allows Kentucky FHA lenders to be more flexible with their requirements for borrowers who may not meet traditional criteria.

How do Kentucky FHA loans work?

KEntucky FHA loans are a government-backed program which makes homeownership more accessible through more lenient lending requirements. With an FHA loan, a borrower could put down as little as 3.5% if their credit score is at least 580, or 10% if their credit score is at least 500. Nevertheless, there is a trade-off; regardless of the amount you put down, there is a requirement to pay for mortgage insurance upfront and monthly premiums and it is for life of loan

The FHA collects a one-time upfront mortgage insurance premium (UFMIP). This premium needs to be entirely financed into the mortgage or paid in full at closing. Additionally, there is an annual mortgage insurance premium, also called monthly MIP, which is collected in monthly installments.

The annual mortgage insurance amount depends on factors such as the loan-to-value ratio (LTV), down payment size, and mortgage term length. Lenders calculate the annual payment as a percentage of the base loan value.

Benefits Of Kentucky FHA Loan

There are several key benefits that make Kentucky FHA loans an attractive option. Here are a few of the benefits:

- Low to zero down Down Payments: FHA loans are designed to help borrowers with limited funds for down payments. Specifically, if your credit score is above 580, you could qualify for a down payment of 3.5%.

- Flexible Credit Requirements: FHA loans have lower credit score requirements compared to conventional loans. Even with a credit score as low as 500, you may qualify with a 10% down payment.

- Lower Debt-to-Income Ratio (DTI): Compared to conventional loans, FHA loans typically allow borrowers with higher levels of debt to still qualify by allowing a higher Debt-to-Income Ratio (DTI).

- Gift Funds and Grants: You could leverage gift funds and grants from family or approved organizations to contribute towards your down payment.

Kentucky FHA Loan Requirements

To be eligible for an Kentucky FHA loan there are some specific requirements you must meet. Here is an overview of these requirements:

FHA Loan Down Payment

The amount you’ll need to pay as a down payment on an FHA loan depends on your credit score. If your credit score is 580 or higher, then you could pay as little as 3.5% of the loan amount. However, if your credit score falls between 500 and 579, you’ll need to pay a larger down payment of 10%. If you’re short on funds, there are several DPA programs available which could help for Kentucky Homebuyers with zero down payments to get into a house.!

Kentucky FHA Mortgage Insurance Premiums

All FHA borrowers, no matter how much of a down payment they make, must purchase both upfront and annual mortgage insurance.

What does Kentucky FHA mortgage insurance cover on your home loan?

Kentucky FHA mortgage insurance protects lenders in case you, the borrower, default on your mortgage. This allows lenders to offer FHA loans with lower down payments and potentially less strict credit score requirements. Essentially, it mitigates the lender’s risk, making Kentucky FHA loans more accessible to first-time homebuyers or those with limited savings.

How much is FHA mortgage insurance?

FHA mortgage insurance has two components – an upfront premium and an annual premium. The upfront premium is a one-time payment that you need to make at the time of loan closing, and it amounts to 1.75% of the loan amount.

On the other hand, the annual premium is a recurring cost that you need to pay as a part of your monthly mortgage payment. The amount of the annual premium may vary depending on factors such as the loan term, loan amount, and loan-to-value ratio (LTV).

Oftentimes, with credit improvement and an increase in home equity (at least 80% loan-to-value), borrowers with FHA loans opt to refinance to a conventional loan program. This helps eliminate the monthly mortgage insurance premium portion of the monthly mortgage payment.

How To Calculate Kentucky FHA Mortgage Insurance

To calculate your Kentucky FHA Mortgage Insurance, you can either use the HUD Calculator or follow these simple steps using your specific information:

- Determine the amount of your loan.

- Calculate your loan-to-value (LTV) ratio by dividing the loan amount by the appraised value of the home.

- Find the annual MIP rate based on your LTV ratio and loan term. You can find this information on the HUD website

- Multiply the loan amount by the annual MIP rate to get the annual MIP amount.

Can I remove KEntucky FHA mortgage insurance?

If you have an FHA loan, you can’t remove the Mortgage Insurance Premium (MIP) as easily as you can with Private Mortgage Insurance (PMI). To remove MIP from your FHA loan, you could refinance into a Conventional Loan. Once your home has at least 20% equity, you typically won’t have to pay PMI with a conventional loan.

Kentucky FHA Minimum Credit Score

To qualify for an Kentucky FHA loan, your FICO credit score needs to be at least 580. IF below 580, you will need 10% down payment and few lenders will do this honestly so it is best to raise your score above 580

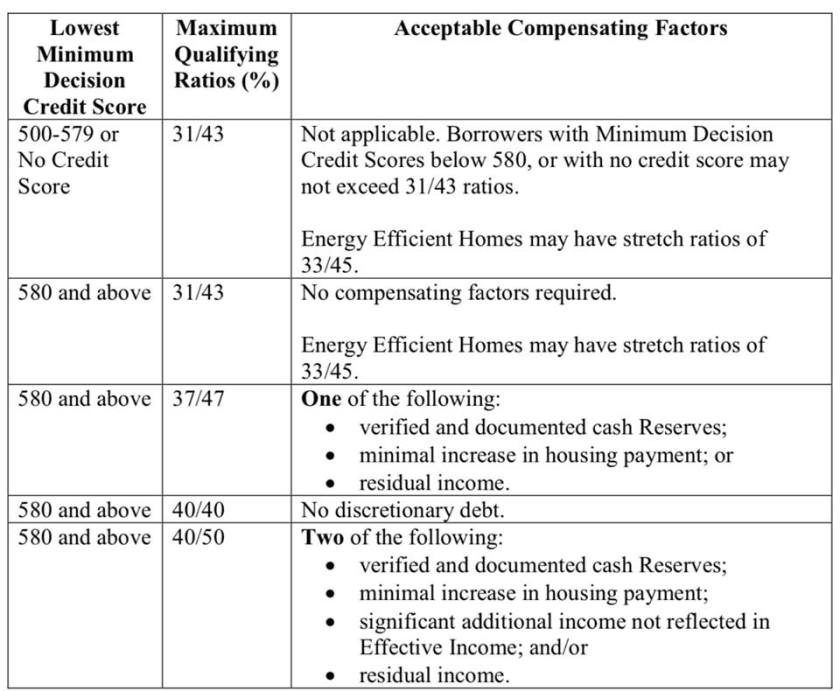

Kentucky FHA Mortgage Debt to Income Ratios

Your debt-to-income ratio is the percentage of your gross income used to cover your mortgage and other debt payments.

Debt to income ratio for FHA loans is 3o to 45% on the front end although this may vary based on your credit score and may go up to 57% with an AUS approval though Fannie Mae DO or Freddie Mac LP underwriting system.

Calculating Your DTI for kentucky FHA Mortgage

To calculate your Debt-to-Income Ratio (DTI) you could either use our mortgage calculator or follow these simple steps:

- Add up all your monthly debt payments, including car loans, student loans, credit card debt, and the estimated monthly mortgage payment for the FHA loan you are considering.

- Calculate your pre-tax gross monthly income.

- Once you have these numbers, use the following formula to calculate your DTI Ratio: DTI Ratio = Total Monthly Debt Payments / Gross Monthly Income.

Kentucky FHA Loan Income Requirements

Kentucky HA loans don’t have any specific minimum or maximum income requirements.

Kentucky FHA Loan Limits

The maximum amount you can borrow on an FHA loan (which is set by The Federal Housing Administration) As of May 2024, the Federal Housing Administration (FHA) loan limits for single-family homes in Kentucky are $498,257

Kentucky FHA Mortgage Rates

Kentucky FHA loans typically have lower interest rates than conventional loans but inline with other government backed loans like Kentucky VA and USDA loans . This is because the Federal Housing Administration (FHA) or HUD , which manages the FHA loan program in Kentucky , insures these mortgages. This insurance protects private lenders from the risk of borrower default, which enables them to offer lower rates with a government guarantee if loan defaults

Types Of Kentucky FHA Loans

FHA loans available, each with unique requirements and benefits. Here are some of the most common options.

Home Purchase

Kentucky FHA loans are commonly used to finance the purchase of a single-family house, townhouse, or condominium, 2-4 units homes in Kentucky.

FHA Rate Term Refinance

A Kentucky FHA Rate Term Refinance enables you to refinance your current Kentucky FHA loan and potentially obtain a lower interest rate or adjust the loan term.

Kentucky FHA Streamline Refinance

The Kentucky FHA Streamline option allows refinancing without an appraisal, providing a fast and simple process for borrowers with existing FHA-insured mortgages that can reduce closing costs due to not having to do an appraisal and skipping a lot of verifications that was done when you use the FHA loan the first time to buy the house.

Kentucky FHA Cash Out Refinance

An Kentucky FHA Cash Out Refinance allows you to leverage the equity you’ve built up in your home by letting you finance up to 80% of the home’s value to use the cash home equity –Refinance must be in a 1st lien position due to FHA does not allow for second mortgages

Kentucky FHA Cash Out Refinance

These loans cater to homebuyers interested in purchasing a fixer upper. FHA 203k loans combine financing for both the purchase and renovation of a property, allowing you to roll renovation costs into your mortgage payment. This eliminates the need for a separate renovation loan, simplifying the financing process.

Kentucky FHA 100% Financing

This program provides homebuyers with 100% financing for Kentcky FHA loans, without requiring a down payment (closing costs are still required). This is achieved through a combination of a 1st and 2nd mortgage.

This DPA program through KHC, 5% grant, and 3.5% grant from Federal Agency can be used to obtain an FHA loan. The 2nd mortgage can be up to 3.5% of the sales price or the appraised value, whichever is less. The term for the 2nd mortgage is 10 years.

Kentucky FHA vs Kentucky Conventional Loan

Kentucky FHA and Kentucky conventional loans are two popular options for financing a home. Nevertheless, there are some differences between the two

Kentucky FHA loans are provided by lenders approved by the Federal Housing Administration and guaranteed by the government. These loans usually have more relaxed eligibility requirements compared to conventional loans, and FHA loans may require smaller down payments. However, you will need to pay mortgage insurance premiums (MIPs) for at least 11 years, or the full term of the loan.

On the other hand, conventional loans are not backed by any government agency and may have stricter lending standards. They may require larger down payments than FHA loans, and if you provide less than 20% as a down payment, you will have to pay for private mortgage insurance (PMI). However, you can request to cancel PMI when your balance reaches 80% of the original home value.

How To Apply For A Kentucky FHA Loan

Find an approved- FHA Lender in Kentucky

To apply for an Kentucky FHA loan, contact me below

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

Documents Needed for a FHA loan in Kentucky

Kentucky FHA Mortgage Application Checklist of Documents Needed below

W-2 forms (previous 2 years)

Paycheck stubs (last 30 days – most current)

Employer name and address with phone number to verify employment (2 year history including any gaps)

Bank accounts statement (recent 2 months – all pages

Statements for 401(k)s, stocks and other investments (most recent)

federal tax returns (previous 2 years)

Residency history (2 year history)

Photo identification for applicant and co-applicant (valid Driver’s License

Can You Have Two Kentucky FHA Loans at One Time?

Properties previously acquired as Investment Properties are not subject to these restrictions.

Listed below are the only circumstances in which a Borrower with an existing FHA-insured Mortgage for a Principal Residence may obtain an additional FHA-insured Mortgage on a new Principal Residence:

RELOCATION – A Borrower may be eligible to obtain another FHA-insured Mortgage without being required to sell an existing Property covered by an FHA-insured Mortgage if the Borrower is:

– relocating or has relocated for an employment-related reason; and

– establishing or has established a new Principal Residence in an area more than 100 miles from the Borrower’s current Principal Residence.

If the Borrower moves back to the original area, the Borrower is not required to live in the original house and may obtain a new FHA-insured Mortgage on a new Principal Residence provided the relocation meets the two requirements above.

INCREASE IN FAMILY SIZE – A Borrower may be eligible for another house with an FHA-insured Mortgage if the Borrower provides satisfactory evidence that:

– the Borrower has had an increase in legal dependents and the Property now fails to meet family needs; and

– the Loan-to-Value (LTV) ratio on the current Principal Residence is equal to or less than 75% or is paid down to that amount, based on the outstanding Mortgage balance and a current residential appraisal.

VACATING A JOINTLY-OWNED PROPERTY – A Borrower may be eligible for another FHA-insured Mortgage if the Borrower is vacating (with no intent to return) the Principal Residence which will remain occupied by an existing co-Borrower.

NON-OCCUPYING CO-BORROWER – A non-occupying co-Borrower on an existing FHA-insured Mortgage may qualify for an FHA-insured Mortgage on a new Property to be their own Principal Residence.

Can you buy a Kentucky duplex with an Kentucky FHA loan?

FHA loans are a great way to finance the purchase of a duplex. Remember, you must live in one of the units as your primary residence for at least one year in order to be eligible for an FHA loan. This requirement is in place because FHA loans are intended to help people buy homes they will live in, not as investment home opportunities. Buying a duplex allows you to earn rental income while also enjoying the experience of being a homeowner.

Can you get an Kentucky FHA loan twice?

Properties previously acquired as Investment Properties are not subject to these restrictions.

Listed below are the only circumstances in which a Borrower with an existing FHA-insured Mortgage for a Principal Residence may obtain an additional FHA-insured Mortgage on a new Principal Residence:

RELOCATION – A Borrower may be eligible to obtain another FHA-insured Mortgage without being required to sell an existing Property covered by an FHA-insured Mortgage if the Borrower is:

– relocating or has relocated for an employment-related reason; and

– establishing or has established a new Principal Residence in an area more than 100 miles from the Borrower’s current Principal Residence.

If the Borrower moves back to the original area, the Borrower is not required to live in the original house and may obtain a new FHA-insured Mortgage on a new Principal Residence provided the relocation meets the two requirements above.

INCREASE IN FAMILY SIZE – A Borrower may be eligible for another house with an FHA-insured Mortgage if the Borrower provides satisfactory evidence that:

– the Borrower has had an increase in legal dependents and the Property now fails to meet family needs; and

– the Loan-to-Value (LTV) ratio on the current Principal Residence is equal to or less than 75% or is paid down to that amount, based on the outstanding Mortgage balance and a current residential appraisal.

VACATING A JOINTLY-OWNED PROPERTY – A Borrower may be eligible for another FHA-insured Mortgage if the Borrower is vacating (with no intent to return) the Principal Residence which will remain occupied by an existing co-Borrower.

NON-OCCUPYING CO-BORROWER – A non-occupying co-Borrower on an existing FHA-insured Mortgage may qualify for an FHA-insured Mortgage on a new Property to be their own Principal Residence.

.

Are Kentucky FHA loans assumable?

|

Assumable Mortgages are a type of financing arrangement in which the outstanding mortgage and its terms can be transferred from the current owner to a buyer.

By assuming the previous owner’s remaining debt, the buyer can avoid having to obtain his or her own mortgage. Buyers are typically attracted to homes with existing assumable mortgages during times of rising interest rates. This is because they can assume the seller’s mortgage, which was created when interest rates were lower, and use it to finance their purchase.

If the home’s purchase price exceeds the mortgage balance by a significant amount, the buyer will either need to provide a sizable down payment or obtain a new mortgage anyway.

For example, if a buyer is purchasing a home for $250,000, and the seller’s assumable mortgage only has a balance of $110,000, the buyer would need a down payment of $140,000 to cover the difference, or would have to get a separate mortgage to secure the needed funds.

|

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS 57916 | Company NMLS #1364/MB73346135166/MBR1574The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the view of my employer. Not all products or services mentioned on this site may fit all people.

NMLS ID# 57916, (www.nmlsconsumeraccess.org).

Debt-to-Income Ratio Requirements –Depending on the automated underwriting system from Desktop Originator, your Debt-to-income ratio is the percentage of your income before taxes that you spend on monthly debt.Taking into account the proposed mortgage payment as well as the other debts, the FHA requires that these debts all total less than 43 percent of your pretax income in order to qualify for the loan.If your debt load is too high, you will struggle to pay all of your bills and mortgage expenses and care for yourself and your family.

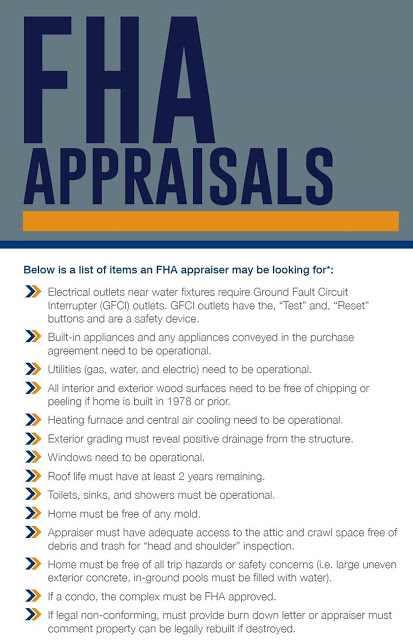

Debt-to-Income Ratio Requirements –Depending on the automated underwriting system from Desktop Originator, your Debt-to-income ratio is the percentage of your income before taxes that you spend on monthly debt.Taking into account the proposed mortgage payment as well as the other debts, the FHA requires that these debts all total less than 43 percent of your pretax income in order to qualify for the loan.If your debt load is too high, you will struggle to pay all of your bills and mortgage expenses and care for yourself and your family. Property Requirements for a Kentucky FHA LoanIt must be the place where you intend to reside. You must move into the home within 60 days of closing the loan. The home cannot be an investment. There will be an inspection to ensure that the home is safe and habitable.It is really not too hard to pass FHA loans and the appraisal process.

Property Requirements for a Kentucky FHA LoanIt must be the place where you intend to reside. You must move into the home within 60 days of closing the loan. The home cannot be an investment. There will be an inspection to ensure that the home is safe and habitable.It is really not too hard to pass FHA loans and the appraisal process. Pros of FHA Loans –

Pros of FHA Loans –