Category: Kentucky Real Estate and Kentucky Appraisal Links

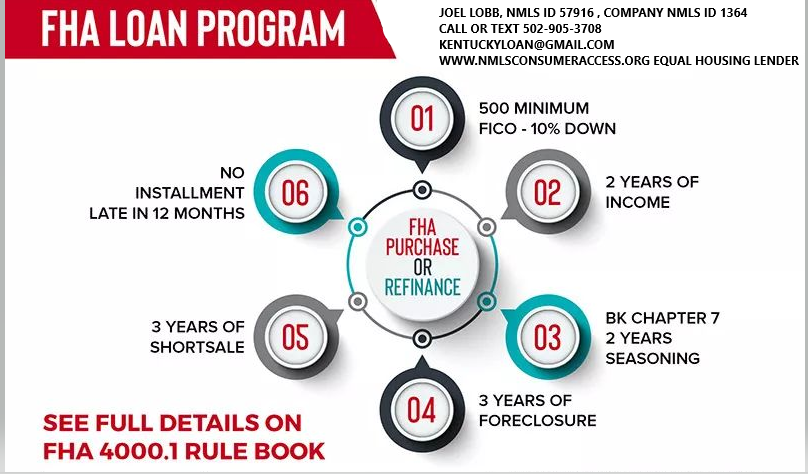

Qualifying for an FHA Loan in Kentucky

When it comes to buying a home in Kentucky, FHA loans are a popular choice for many first-time homebuyers due to their flexible qualifying criteria. If you’re considering an FHA loan in the Bluegrass State, understanding the key qualifying factors is crucial. Here’s a comprehensive guide to the criteria you need to know: Understanding these … Continue reading “Qualifying for an FHA Loan in Kentucky”

When it comes to buying a home in Kentucky, FHA loans are a popular choice for many first-time homebuyers due to their flexible qualifying criteria. If you’re considering an FHA loan in the Bluegrass State, understanding the key qualifying factors is crucial. Here’s a comprehensive guide to the criteria you need to know:

- Credit Score Requirements:

- FHA loans are known for accommodating borrowers with lower credit scores. While the minimum required credit score can vary, typically, a credit score of 580 or higher is needed to qualify for the minimum down payment of 3.5%. However, borrowers with credit scores between 500 and 579 may still be eligible with a higher down payment, usually around 10%.

- Down Payment:

- The minimum down payment for an FHA loan in Kentucky is 3.5% of the home’s purchase price. This is advantageous for buyers who may not have substantial savings for a larger down payment, making homeownership more accessible.

- Work History:

- Lenders typically look for a steady 2 year employment history when considering FHA loan applications. A consistent work history, preferably with the same employer or within the same field, helps demonstrate financial stability and the ability to repay the loan.

- Debt-to-Income Ratio (DTI):

- The debt-to-income ratio is a crucial factor in mortgage approval. For FHA loans, the maximum allowable DTI ratio is typically around 40% to 45% of your gross monthly income and can go higher up to 56% with good credit scores, large down payment or shorter term loan although lenders may consider higher ratios in certain cases if compensating factors are present.

- Bankruptcy and Foreclosure:

- FHA loans have lenient guidelines regarding bankruptcy and foreclosure. Generally, borrowers with a past bankruptcy may qualify for an FHA loan after two years if they have re-established good credit and demonstrated responsible financial behavior. For foreclosures, the waiting period is usually three years.

- Mortgage Term:

- FHA loans offer various mortgage term options, including 15-year and 30-year fixed-rate loans. The choice of term depends on your financial goals and ability to manage monthly payments.

- Occupancy: Primary residences not for rental properties

- Mortgage Insurance on the loan for life of loan. Larger down payments and shorter terms will reduce the upfront mi and monthly mi premiums

- can be used for refinances, not only for purchases.

- Max FHA loan in Kentucky is $498,257. This changes every year

- No income limits nor property restrictions on where home is located

- Can close within 30 days typically with good appraisal and title work

Understanding these qualifying criteria can help you navigate the FHA loan application process in Kentucky more effectively. Working with an experienced mortgage professional can also provide valuable guidance and assistance tailored to your specific financial situation and homeownership goals.

Joel Lobb Mortgage Loan Officer

American Mortgage Solutions, Inc.10602 Timberwood Circle

Louisville, KY 40223

Company NMLS ID #1364

Text/call: 502-905-3708

fax: 502-327-9119

email: kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

NMLS 57916 | Company NMLS #1364/MB73346135166/MBR1574

NMLS ID# 57916, (www.nmlsconsumeraccess.org).

5 Things to Know about buying a house and getting a Mortgage Loan approval in Kentucky for 2023

5 Things to Know about buying a house and getting a Mortgage Loan approval in Kentucky for 2023

1. Do Mortgage Rates Change Daily?

Just like the gas prices at the pump, mortgage rates can change daily or throughout the day. Typically mortgage rates are published at 10-11 am daily by most lenders and you can lock up through the close of business which is usually around 6-7 PM. Mortgage rates can change up or down throughout the day based on various financial, economics, and geopolitical news in the US Financial markets and World markets. Generally speaking, good economic news is bad for rates and vice versa, bad economic news is good for mortgage rates.

The good news is this: Once you find a home and get it under contract, you can lock your mortgage loan rate. Typically it takes about 30-45 days to close a mortgage loan in Kentucky, so the typical lock is for 30-60 days. If rates get better you may be able to negotiate a better rate with your lender, but they usually have to improve by at least 25 basis points (.25) to do that. Not all lenders offer this option. The longer you lock the loan, the greater the costs. It is usually free to lock in a loan for up to 90 days without having to pay a fee.

What a lot of lenders are experiencing now is that some loans don’t close on time for various reasons. You can always extend the lock on the loan but it will costs you usually .125 basis points to do so. If you let the lock expire on the loan, then you have to take worse case pricing on that day when you go to relock. It is usually best to extend the lock on your loan.

2. What kind of Credit Score Do I need to qualify?

When applying for a mortgage loan, lenders will pull what they call a “tri-merge” credit report which will show three different fico scores from Trans union, Equifax, and Experian. The lenders will throw out the high and low score and take the “middle score” For example, if you had a 614, 610, and 629 score from the three main credit bureaus, your qualifying score would be 614. Most lenders will want at least two scores. So if you only have one score, you may not qualify. Lenders will have to pull their own credit report and scores so if you had it ran somewhere else or saw it on a website or credit card you may own, it will not matter to the lender, because they have to use their own credit report and scores.

Most lenders will pull your credit report for free nowadays so this should not be a big deal as long as your scores are high enough.

The Secondary Market of Mortgage loans offered by FHA, VA, USDA, Fannie Mae, and KHC all have their minimum fico score requirements and lenders will create overlays in addition to what the Government agencies will accept, so even if on paper FHA says they will go down to 580 or 500 in some cases on fico scores, very few lenders will go below the 620 threshold.

If you have low fico scores it may make sense to check around with different lenders to see what their minimum fico scores are for loans.

The lenders I currently deal with have the following fico cutoffs for credit scores:

FHA–580 minimum score

VA—-580 minimum score

Fannie Mae–620 minimum score

USDA–620 minimum score

KHC with Down Payment Assistance –620 minimum score.

As you can see, 580-620 is the minimum score with most lenders for a FHA, VA, or Fannie Mae loan, is required for the no down payment programs offered by USDA for Kentucky for First Time Home Buyers wanting to go no money down.

3. What are the down payment requirements?

The most popular programs for Kentucky First Time Home Buyers usually involves one of the following housing programs outlined in bold below:

FHA:

FHA will allow a home buyer to purchase a house with as little as 3.5% down. If your credit scores are low, say 680 and below, a lot of times it makes sense to go FHA because everyone pays the same mortgage insurance premiums no matter what your score is, and the down payment can be gifted to you. Meaning you really don’t have to have any skin into the game when it comes to down payment.

They even allow down payment assistance for down payment requirements of 3.5% through eligible parties like Kentucky Housing, Welcome Home Grants and Louisville KY and Covington Kentucky Down Payment Grants.

Lastly, FHA will allow for higher debt to income ratios with sometimes getting loan pre-approvals up to 55% of your total gross monthly income. So if you have a debt to income ratio of over 50%, Fannie Mae will not do the loan and USDA usually likes their debt to income ratios no more than 45%.

Think back to the last time you financed a purchase — be it a home, automobile, or what have you… You may remember having heard the term “debt-to-income ratio.” Today I want to spend some time going over exactly what this ratio is, and to also touch on how it can effect your personal finances.

4. What is your debt-to-income ratio?

Commonly referred to as your “DTI,” your debt-to-income ratio is a personal finance benchmark that relates your monthly debt payments to your monthly gross income.

As an example… Let’s say that your gross monthly salary is $5,000 and you are spending $2,800 of it toward monthly debt payments. In that case, your DTI would be an unhealthy 56%.

This version of your DTI is sometimes referred to as your “back-end” DTI. This is often broken down further to give a front-end debt-to-income ratio, which is a component of your back-end DTI.

How to calculate your front-end DTI for a Kentucky Mortgage Loan Approval

Your front-end DTI is calculated by dividing your monthly housing costs by your monthly gross income. Front-end DTI for renters is simply the amount paid in rent, whereas for homeowners it is the sum of mortgage principal, interest, property taxes, and home insurance (i.e., your PITI) divided by gross monthly income.

From above, if that $2,800 in debt payments is attributable to $1,500 in housing costs and $1,300 in non-housing costs, then your front-end DTI is $1,500/$5,000 = 30% (and your back-end ratio is still 56%, as calculated above).

Fannie Mae:

Fannie Mae requires just 3% down with their new Home Possible Program, but if you use their traditional mortgage loan, then 5% is the Fannie Mae Standard. Fannie Mae will go down 620 score, but if your scores are below 680, I would look seriously at the FHA loan program because Fannie Mae has steep increases to the interest rate and the mortgage insurance premiums if your scores are low.

A couple of good things about Fannie Mae is that you can buy a larger priced home and have a large loan amount due to FHA only allowing most Kentucky Home Buyers a maximum mortgage loan amount of $356,000 for a max FHA loan and $545,000 for Fannie Mae Conventional loans in Kentucky for 2020.

Lastly when it comes to mortgage insurance, FHA mortgage insurance premiums are for life of loan while Fannie Mae mortgage insurance premiums drop off when you develop 80% equity position in your house.

But as a tell most people, nobody has a loan for 30 years, and the average mortgage is either refinanced or home sold within the first 5-7 years.

VA Loans-

VA loans offer eligible Veterans and Active Duty Personnel to buy a home going no money down with no monthly mortgage insurance. This is probably the best no money down loan out there since the rates are traditionally very low on comparison to other government insured mortgages and no monthly mortgage insurance. The VA loan can be used anywhere in the state of Kentucky with the maximum VA loan limit being removed for 2021

USDA Loans-

USDA loans offer people buying a home in rural areas (typically towns of $20k or less) to buy a home going zero down. You cannot currently own another home and there is household income limits of $90,200 for a household family of four, and up to $119,300 for a household of five or more. You search USDA website for eligible areas and household income limits below at the yellow highlighted link :

KHC or Kentucky Housing-

Kentucky First Time Home Buyers typically use KHC for their down payment assistance. KHC currently offers $10,000 for down payment assistance and sometimes throughout the year they will offer low mortgage rates on their mortgage revenue bond program.

The down payment assistance usually never runs out because you have to pay it back in the form of a second mortgage. It helps a lot of home buyers that want to buy in urban areas that cannot utilizer the USDA program in rural areas. Most of the time the first mortgage is a FHA loan tied with the 2nd mortgage fore down payment assistance. All KHC programs require a 620 score and rates are locked for 45 days.

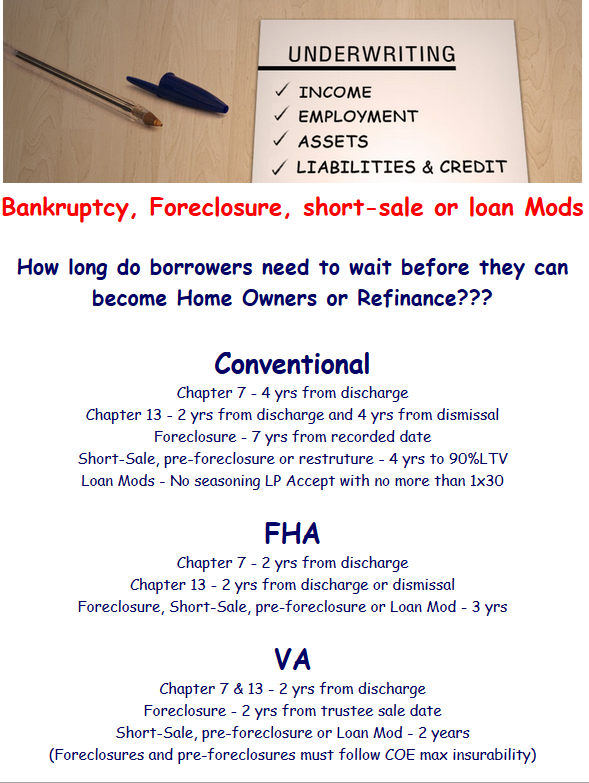

5. What if I have had a bankruptcy or foreclosure in the past?

FHA and VA are the easiest on previous bankruptcies. FHA and VA both require 2 years removed from the discharge date on a Chapter 7. If you are in the middle of a Chapter 13, FHA will allow for financing with a 12 month clean history payment to the Chapter 13 courts, and with trustee permission.

VA requires 2 years removed from a foreclosure (sheriff sale date of home) and FHA requires 3 years.

USDA requires 3 years removed from both a foreclosure and bankruptcy, but on the foreclosure they do not go off the sale date. This may save you a little time if you had a previous foreclosure.

Fannie Mae (Conventional Loan)

Fannie Mae is by far the strictest. They require 4-7 years out of a foreclosure or bankruptcy

If you have questions about qualifying as first time home buyer in Kentucky, please call, text, email or fill out free prequalification below for your next mortgage loan pre-approval.

Joel Lobb

Senior Loan Officer

(NMLS#57916)

Text or call phone: (502) 905-3708

email me at kentuckyloan@gmail.com

http://www.mylouisvillekentuckymortgage.com/

The view and opinions stated on this website belong solely to the authors, and are intended for informational purposes only. The posted information does not guarantee approval, nor does it comprise full underwriting guidelines. This does not represent being part of a government agency. The views expressed on this post are mine and do not necessarily reflect the views of my employer. Not all products or services mentioned on this site may fit all people

CONFIDENTIALITY NOTICE: This message is covered by the Electronic Communications Privacy Act, Title 18, United States Code, §§ 2510-2521. This e-mail and any attached files are deemed privileged and confidential, and are intended solely for the use of the individual(s) or entity to whom this e-mail is addressed. If you are not one of the named recipient(s) or believe that you have received this message in error, please delete this e-mail and any attached files from all locations in your computer, server, network, etc., and notify the sender IMMEDIATELY at 502-327-9770. Any other use, re-creation, dissemination, forwarding, or copying of this e-mail and any attached files is strictly prohibited and may be unlawful. Receipt by anyone other than the named recipient(s) is not a waiver of any attorney-client, work product, or other applicable privilege. E-mail is an informal method of communication and is subject to possible data corruption, either accidentally or intentionally. Therefore, it is normally inappropriate to rely on legal advice contained in an e-mail without obtaining further confirmation of said advice.

Bank Statement Basics for A Kentucky Mortgage Loan Approval for USDA, KHC, FHA, VA, Fannie Mae and Rural Housing Mortgage Loans

-

Assets:

- Assets are not required; however, any assets disclosed must be supported with appropriate documentation

- Satisfactory explanation and documentation should be provided for large deposits or increases in liquid assets

- Cash on hand is not acceptable

- Bank accounts require Verification of Deposit with average 2 month balance, or 2 consecutive months statements dated within 45 days of loan application

- Earnest money deposit may be considered an asset if deposit is not already reflected in liquid assets

- Asset amount of retirement accounts is 60% of the vested account balance

- Gifts must be documented through gift donor letter and establish that gift does not have to be repaid

- For sale proceeds of real property, provide HUD-1 or equivalent closing statement to indicate the actual amount of cash proceeds realized by the borrower

- Stocks and bonds must be documented by a statement provide by stockbroker or financial institution managing the portfolio

- Households with net family assets of greater than $5,000 require that the actual income derived from all net family assets or a percentage of the value of such assets based on the current passbook savings rate be considered when calculating income.

- Government shutdown affects on USDA, FHA, VA, Rural Housing, KHC and Fannie Mae Mortgage loans in Kentucky (mylouisvillekentuckymortgage.com)

- Kentucky Housing Corporation (KHC) homeownership programs affected by the current federal government shutdown (mylouisvillekentuckymortgage.com)

- Louisville Ky Mortgage Lender FHA/VA KHC USDA Kentucky Mortgage: Kentuck… (mylouisvillekentuckymortgage.com)

Give us a try or let us compare your options on your next mortgage transaction. Call me locally at 502-905-3708. Free Mortgage Pre-Qualifications same day on most applications.

Email me at kentuckyloan@gmail.com with your questions

I specialize in Kentucky FHA, VA ,USDA, KHC, Conventional and Jumbo mortgage loans. I am based out of Louisville Kentucky. For the first time buyer with little money down, we offer Kentucky Housing or KHC loans with down payment assistance.

This website is not an government agency, and does

not officially represent the HUD, VA, USDA or FHA or any other government agency.

NMLS# 57916 http://www.nmlsconsumeraccess.org/

Joel Lobb Senior Loan Officer

American Mortgage Solutions, Inc.

10602 Timberwood Circle Suite 3

Louisville, KY 40223

phone: (502) 905-3708

Fax: (502) 327-9119

kentuckyloan@gmail.com

Company ID #1364 | MB73346E

EQUAL HOUSING LENDER

Kentucky FHA Property Flipping Guidelines

FHA’s re-sale restriction period is defined as the time between the date of acquisition (original settlement date) and the date of execution of the new sales contract (the new loan closing date)

Re-sales of a property less than 90 days after acquisition are not eligible for an FHA insured mortgage

Re-sales occurring between 91 and 180 days of acquisition with a sale price 100% over the original purchase price must have the value supported by a 2nd appraisal

Re-Sales occurring between 91 days and 12 months of acquisition with a re-sale price 5% greater than the lowest sales price of the property during the 12 months preceding the sales contract may be subject to a 2nd appraisal

Exceptions to the time restrictions on sales:

Sales by HUD of Real Estate-Owned (REO) properties under 24 CFR part 291 and of single family assets in revitalization areas pursuant to section 204 of the National Housing Act (12 U.S.C. 1710);

Sales by another agency of the United States Government of REO single family properties pursuant to programs operated by these agencies;

Sales of properties by nonprofit organizations approved to purchase HUD REO single family properties at a discount with resale restrictions;

Sales of properties that were acquired by the sellers by inheritance;

Sales of properties purchased by an employer or relocation agency in connection with the relocation of an employee;

Sales of properties by state- and federally-chartered financial institutions and government-sponsored enterprises (GSEs);

Sales of properties by local and state government agencies; and

Only upon announcement by HUD through issuance of a notice, sales of properties located in areas designated by the President as federal disaster areas. The notice will specify how long the exception will be in effect.

Read More about Flipping Rules for FHA, VA , USDA and KY Housing Mortgage Loanss in Kentucky at the link below

👇👇👇

Joel Lobb (NMLS#57916)

Senior Loan Officer

Senior Loan Officer

American Mortgage Solutions, Inc.

Company ID #1364 | MB73346

Text/call 502-905-3708

kentuckyloan@gmail.com

Disclaimer: No statement on this site is a commitment to make a loan. Loans are subject to borrower qualifications, including income, property evaluation, sufficient equity in the home to meet Loan-to-Value requirements, and final credit approval. Approvals are subject to underwriting guidelines, interest rates, and program guidelines and are subject to change without notice based on applicant’s eligibility and market conditions. Refinancing an existing loan may result in total finance charges being higher over the life of a loan. Reduction in payments may reflect a longer loan term. Terms of any loan may be subject to payment of points and fees by the applicant Equal Opportunity Lender. NMLS#57916http://www.nmlsconsumeraccess.org/

— Some products and services may not be available in all states. Credit and collateral are subject to approval. Terms and conditions apply. This is not a commitment to lend. Programs, rates, terms and conditions are subject to change without notice. The content in this marketing advertisement has not been approved, reviewed, sponsored or endorsed by any department or government agency. Rates are subject to change and are subject to borrower(s) qualification.